Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - mid year forecast

News

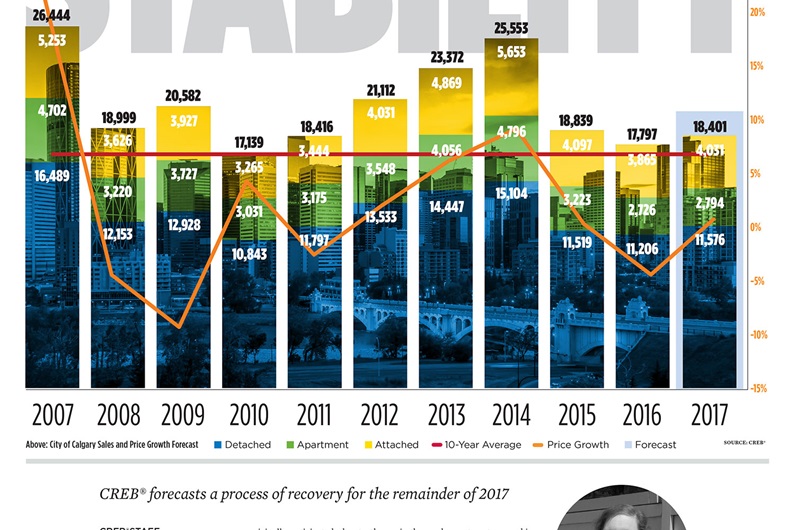

Aug. 16, 2017 | CREBNow

Mid-year market update shows stability

CREB® forecasts a process of recovery for the remainder of 2017

The first-half of 2017 marked a shift in Alberta's economy from recession to recovery, with conditions supporting stability rather than expansion.

"Economic challenges continue to exist, as high unemployment rates, weak migration levels and more stringent lending conditions are weighing on the housing market," said CREB® chief economist Ann-Marie Lurie.

"This will continue to cause some adjustments in the housing market for the remainder of this year. However, this is not expected to offset earlier gains supporting general stability in 2017."

The first-half of 2017 marked a shift in Alberta's economy from recession to recovery, with conditions supporting stability rather than expansion.

"Economic challenges continue to exist, as high unemployment rates, weak migration levels and more stringent lending conditions are weighing on the housing market," said CREB® chief economist Ann-Marie Lurie.

"This will continue to cause some adjustments in the housing market for the remainder of this year. However, this is not expected to offset earlier gains supporting general stability in 2017."

News

Aug. 26, 2016 | Joel Schlesinger

Listing leverage

Price declines being moderated by lack of listing activity, say experts

The numbers don't lie, but they can be misleading.

Calgary's real estate market so far this year has continued a pattern of year-over-year declines that was first set early in 2015.

According to CREB®, sales decreased by more than 10 per cent up to the end of July from the same time last year.

Yet, perhaps surprising, is the benchmark price is down just 3.7 per cent.

The numbers don't lie, but they can be misleading.

Calgary's real estate market so far this year has continued a pattern of year-over-year declines that was first set early in 2015.

According to CREB®, sales decreased by more than 10 per cent up to the end of July from the same time last year.

Yet, perhaps surprising, is the benchmark price is down just 3.7 per cent.

News

Aug. 12, 2016 | Carl Patzel

Mirror image

Satellite communities showing similar signs of strain; officials still optimistic

Feeling the pinch of a slowing economy, smaller satellite community housing markets have mirrored a downward drift in prices compared with Calgary but continue to be an attractive draw for buyers.

Depending on the region, CREB®'s mid-year forecast update has shown only a slight reduction in sales compared to long-term trends and actual growth in other outlaying districts.

Still buzzing with plenty of activity in new-home construction, Airdrie sales activity slowed in 2016 but hasn't dropped compared to five-year averages. A continual inventory build-up has kept new listings on pace with the past three years for Airdrie, which experienced a 5.37 per cent population growth since last summer and has recently surpassed 60,000 residents.

Feeling the pinch of a slowing economy, smaller satellite community housing markets have mirrored a downward drift in prices compared with Calgary but continue to be an attractive draw for buyers.

Depending on the region, CREB®'s mid-year forecast update has shown only a slight reduction in sales compared to long-term trends and actual growth in other outlaying districts.

Still buzzing with plenty of activity in new-home construction, Airdrie sales activity slowed in 2016 but hasn't dropped compared to five-year averages. A continual inventory build-up has kept new listings on pace with the past three years for Airdrie, which experienced a 5.37 per cent population growth since last summer and has recently surpassed 60,000 residents.

News

Aug. 12, 2016 | Jamie Zachary

Five things about CREB®'s Mid-Year Forecast

Breaking it down by the numbers

Earlier this year, CREB®Now published a feature on five things you needed to know about CREB®'s 2016 Economic Outlook & Regional Housing Market Forecast. With the REALTOR® organization recently updating the document, we revisit those insights on what's to come:

17,321

After originally forecasting 18,416 sales in 2016, CREB® is now predicting Calgary's activity to fall to 17,321, a 3.8 per cent drop from last year. By sector, revised estimated peg detached to decline by five per cent, while attached and apartment will be down by eight and 19 per cent, respectively. Meanwhile, CREB® chief economist Ann-Marie Lurie said the year began by favouring buyers, but is exhibiting more balanced conditions in areas such as the detached sector.

Earlier this year, CREB®Now published a feature on five things you needed to know about CREB®'s 2016 Economic Outlook & Regional Housing Market Forecast. With the REALTOR® organization recently updating the document, we revisit those insights on what's to come:

17,321

After originally forecasting 18,416 sales in 2016, CREB® is now predicting Calgary's activity to fall to 17,321, a 3.8 per cent drop from last year. By sector, revised estimated peg detached to decline by five per cent, while attached and apartment will be down by eight and 19 per cent, respectively. Meanwhile, CREB® chief economist Ann-Marie Lurie said the year began by favouring buyers, but is exhibiting more balanced conditions in areas such as the detached sector.

News

Aug. 10, 2016 | Jamie Zachary

Moving forward

CREB®'s mid-year update cites tough start to 2016, forecasts continued challenges moving forward

Calgary's housing market will continue to battle recessionary conditions during the second half of 2016, but the worse might be behind it.

That's the word from CREB® as it released a mid-year update to its annual Economic Outlook & Regional Housing Market Forecast.

"With no near-term changes expected in the economic climate, housing demand is expected to remain weak for the second consecutive year as resale activity is forecasted to decline by eight per cent in 2016," said CREB® chief economist Ann-Marie Lurie, who authored the report.

Calgary's housing market will continue to battle recessionary conditions during the second half of 2016, but the worse might be behind it.

That's the word from CREB® as it released a mid-year update to its annual Economic Outlook & Regional Housing Market Forecast.

"With no near-term changes expected in the economic climate, housing demand is expected to remain weak for the second consecutive year as resale activity is forecasted to decline by eight per cent in 2016," said CREB® chief economist Ann-Marie Lurie, who authored the report.

News

Aug. 06, 2015 | Shelley Boettcher

Migration to moderate

Housing demand expected to weaken

Mike Dunn moved to Calgary from Edmonton in July. He'd been thinking for a while about relocating, but when a friend offered him an affordable place to stay, he decided to take the plunge.

"It was like walking into a hurricane, to land here during Stampede, but it was good," he said with a laugh. "It seems like a place where if you work hard, you can pull off a decent living."

Dunn's not the first to switch area codes – and he won't be the last.

But he does represent a smaller number, as net migration — the difference between the number of people who have moved to Calgary, compared to the number who have moved away from the city — is at its lowest since 2011.

Mike Dunn moved to Calgary from Edmonton in July. He'd been thinking for a while about relocating, but when a friend offered him an affordable place to stay, he decided to take the plunge.

"It was like walking into a hurricane, to land here during Stampede, but it was good," he said with a laugh. "It seems like a place where if you work hard, you can pull off a decent living."

Dunn's not the first to switch area codes – and he won't be the last.

But he does represent a smaller number, as net migration — the difference between the number of people who have moved to Calgary, compared to the number who have moved away from the city — is at its lowest since 2011.

News

Aug. 04, 2015 | Alex Frazer Harrison

Rosy picture for rentals

Several factors contributing to more favourable conditions

Calgary's rental market is emerging as an early winner this year as the result of improved vacancy rates, added inventory and a more conservative appetite among buyers in the resale housing sector.

CREB®'s mid-year forecast update, released earlier this week, notes more choice and less upward pressure on rents has, and will continue to, impact the resale market as more consumers choose to keep renting.

An April report from the Canadian Mortgage and Housing Corp. (CMHC) showed two-bedroom apartment and row vacancy rates rose to 3.6 per cent in 2015 – the highest level since 2010 – from 1.5 per cent the year prior.

Calgary's rental market is emerging as an early winner this year as the result of improved vacancy rates, added inventory and a more conservative appetite among buyers in the resale housing sector.

CREB®'s mid-year forecast update, released earlier this week, notes more choice and less upward pressure on rents has, and will continue to, impact the resale market as more consumers choose to keep renting.

An April report from the Canadian Mortgage and Housing Corp. (CMHC) showed two-bedroom apartment and row vacancy rates rose to 3.6 per cent in 2015 – the highest level since 2010 – from 1.5 per cent the year prior.

News

Aug. 01, 2015 | Joel Schlesinger

Bursting the bubble on overvaluation

Several reports have sounded the alarm our real estate market is grossly overvalued, but industry watchers contend Calgary isn't poised for the big crash some are forecasting

Reports suggesting Calgary's housing market is over-valued, supported by recent price corrections, are missing many of the obvious indicators saying otherwise, say experts.

The metrics used to measure affordability simply do not back up the argument that Calgary's real estate market is highly overvalued and ready for a precipitous drop in home values, said Robert Kavcic, a senior economist with Economic Research BMO Capital Markets in Toronto.

"One of the (metrics) we look at is the average mortgage payment as a share of income, and right now that's a little bit above the long-run norm of 27 per cent at about 29 per cent," he said.

Reports suggesting Calgary's housing market is over-valued, supported by recent price corrections, are missing many of the obvious indicators saying otherwise, say experts.

The metrics used to measure affordability simply do not back up the argument that Calgary's real estate market is highly overvalued and ready for a precipitous drop in home values, said Robert Kavcic, a senior economist with Economic Research BMO Capital Markets in Toronto.

"One of the (metrics) we look at is the average mortgage payment as a share of income, and right now that's a little bit above the long-run norm of 27 per cent at about 29 per cent," he said.

News

July 31, 2015 | Cody Stuart

Where we're going . . .

Outside factors will impact housing market through 2016

With the sun in Calgary rising and falling relative to the price of a barrel, it should be no surprise that the city's real estate market will continue to be impacted by economic realities beyond its control, say housing analysts.

Following a first half that can best be described as turbulent, the remainder of 2015 looks to bring more of the same for the city's housing market, with CREB®'s mid-year forecast update suggesting decreases across the board, including moderate price contraction.

"Further job losses are expected in the second half of the year," said CREB® chief economist Ann-Marie Lurie.

"These employment changes, combined with overall weakness and slower-than-anticipated recovery of oil prices, are expected to keep housing demand relatively weak for the rest of 2015.

With the sun in Calgary rising and falling relative to the price of a barrel, it should be no surprise that the city's real estate market will continue to be impacted by economic realities beyond its control, say housing analysts.

Following a first half that can best be described as turbulent, the remainder of 2015 looks to bring more of the same for the city's housing market, with CREB®'s mid-year forecast update suggesting decreases across the board, including moderate price contraction.

"Further job losses are expected in the second half of the year," said CREB® chief economist Ann-Marie Lurie.

"These employment changes, combined with overall weakness and slower-than-anticipated recovery of oil prices, are expected to keep housing demand relatively weak for the rest of 2015.

News

July 31, 2015 | Cody Stuart

Where we've been . . .

Roller-coaster ride to start 2015 ended with more balanced conditions

The arrival of 2015 was bound to signal a change of pace for Calgary's resale real estate industry, which had just wrapped a bow around a banner 2014.

In fact, with oil prices showing signs of deteriorating toward the end of 2014, December's four per cent sales decline – following 11 consecutive months of sales increases –was really a sign of things to come.

"Changes in the economic climate are expected to cool housing market conditions in 2015, and December activity may be the first indication of this shift," said CREB® chief economist Ann-Marie Lurie at the time.

That change came early and it came swift, with sales falling by more than 30 per cent in January to five-year lows even though new listings maintained their upward momentum by increasing by 37 per cent compared to the same period last year.

The arrival of 2015 was bound to signal a change of pace for Calgary's resale real estate industry, which had just wrapped a bow around a banner 2014.

In fact, with oil prices showing signs of deteriorating toward the end of 2014, December's four per cent sales decline – following 11 consecutive months of sales increases –was really a sign of things to come.

"Changes in the economic climate are expected to cool housing market conditions in 2015, and December activity may be the first indication of this shift," said CREB® chief economist Ann-Marie Lurie at the time.

That change came early and it came swift, with sales falling by more than 30 per cent in January to five-year lows even though new listings maintained their upward momentum by increasing by 37 per cent compared to the same period last year.