Feb. 01, 2023 | CREB

Supply of lower-priced homes remains low for January

City of Calgary, Feb. 1, 2023 – The level of new listings in January fell to the lowest levels seen since the late 90s. While new listings fell in nearly every price range, the pace of decline was higher for lower-priced properties.

At the same time, sales activity did slow compared to the high levels reported last year but remained consistent with long-term trends. However, there has been a shift in the composition of sales as detached homes only comprised 47 per cent of all sales.

“Higher lending rates are causing many buyers to seek out lower-priced products in our market,” said CREB® Chief Economist Ann-Marie Lurie. “However, the higher rates are likely also preventing some move-up activity in the market impacting supply growth for lower-priced homes. This is causing differing conditions in the housing market based on price range.”

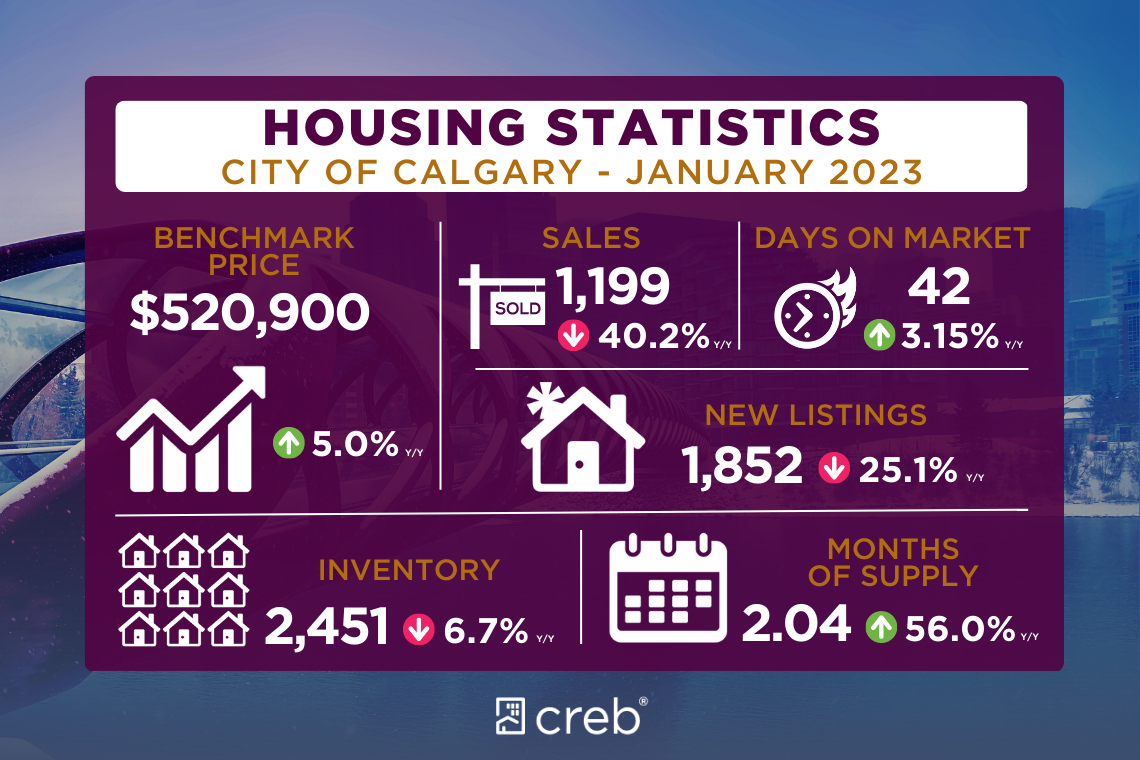

With 2,451 units available in inventory, levels remain 43 per cent lower than long-term trends for the month. While overall inventory levels are slightly lower than last January, there is significant variation by price range. Homes priced under $500,000 reported year-over-year inventory declines of nearly 30 per cent while inventory levels improved for homes prices above that level.

Although conditions are not as tight as last year, lower supply levels are preventing a significant shift toward balanced conditions and prices did trend up slightly over last month breaking the seven consecutive month slide. As of January, the benchmark price reached $520,900, 5 per cent higher than last January, but still well below the May 2022 high of $546,000.

Detached

Detached home sales saw the largest pullback despite the year-over-year rise in inventory levels. Higher lending rates are cooling demand for higher-priced homes which is supporting inventory gains. Meanwhile, a limited supply of lower-priced products is preventing stronger sales in the lower price ranges.

The variation within the market is likely causing divergent trends in pricing as prices have trended down in the higher-priced City Centre, while still reporting some modest gains in other districts of the city. Overall, the benchmark price reached $622,800 in January, slightly higher than levels reported in December, but still below the monthly high achieved in May 2022.

Semi-Detached

Sales in January slowed relative to last year’s levels but remained above levels achieved before the pandemic. At the same time, a pullback in new listings has left inventory levels below the already low levels reported last January. Like the detached sector, semi-detached homes have seen shifts where the demand remains strong for lower-priced product relative to the supply likely causing divergent trends in pricing.

In January, most districts reported a monthly benchmark price growth. However, prices did trend down in the higher-priced City Centre district causing Calgary’s semi-detached benchmark prices to ease slightly over levels seen in December 2022. Despite the monthly adjustment overall, prices remained nearly six per cent higher than levels reported in January 2022.

Row

Row homes sales slowed over last year’s record high but remained well above long-term trends for the month. Sales would have likely been stronger if more listings came onto the market. In January, new listings dropped over the previous year and were over 20 per cent below long-term trends. The adjustments in both sales and new listings did little to change the low inventory scenario and the months of supply remained below two months in January.

The persistently tight conditions did also prevent any downward pressure on prices which posted a nearly one per cent gain over December levels. With a benchmark price of $361,400, levels are still over 12 per cent higher than last January, and only slightly lower than the $363,700 monthly high achieved in June 2022.

Apartment Condominium

Sales for apartment condominiums did not see the same pace of decline as other property types in January partly due to the level of new listings coming onto the market. Nonetheless, inventory levels remained well below long-term trends for the month and have not been this low in January since 2014.

The adjustments to both sales and inventory have left this sector with a months of supply that is lower than levels seen at the start of 2022. The shift to affordable options is also impacting prices within the apartment condominium sector. In January, prices trended up from December levels driven by strong gains in the lower priced district of the North East and East. Overall, apartment condominium prices in the city reached $277,600, one per cent higher than last month and a year-over-year gain of nearly 10 per cent, narrowing the spread from the record high prices set in 2014.

REGIONAL MARKET FACTS

Airdrie

January sales eased over last year’s record high but remained consistent with long-term trends for the month. The pullback in sales did outpace the pullback in new listings causing inventory levels to improve over the exceptionally low levels reported last year. Despite the inventory gain, levels remain over 50 per cent lower than long-term trends for January

These shifts in the market have caused the months of supply to rise over last January’s 2022 record low. However, with less than two months of supply, conditions continue to remain relatively tight and supported a modest monthly price gain. In January, the benchmark price reached $480,200, nearly eight per cent higher than last January, but still below the monthly peak of $510,700 achieved in April 2022.

Cochrane

January sales eased over last year’s record high but remained comparable to long-term trends for the month. At the same time, new listings also slowed, but not at the same pace as sales. Inventory levels also rose from the near record lows reported last January. While improving inventories is likely welcome news to most buyers, inventory levels are still nearly 40 per cent below long-term trends.

Shifts in both sales and inventory have caused the months of supply to rise to nearly three months. This has taken some of the pressure off home prices which have seen exceptional gains over the past two years. Overall, the benchmark price in January was $488,900, over one per cent lower than last month but still seven per cent higher than January 2022 levels.

Okotoks

Both sales and new listings slowed in January compared to last year, preventing any significant addition to inventory compared to what was available in the market at the end of 2022. While there is more supply in the market compared to last January’s record low, with only 56 units available, this is still 61 per cent below long-term trends for the town.

The persistently tight market conditions have supported significant price growth over the past several years. While recent shifts have taken some of the pressure off the pace of price growth, prices did see some further gains this month. In January, the benchmark price reached $539,000, an increase from December and a year-over-year gain of nearly seven per cent.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

-30-

For more information, please contact:

Economic Analysis

Email: stats@creb.ca

Phone: 403-263-0530