Jan. 02, 2024 | CREB

Strong migration and low supply drive Calgary housing prices in 2023

Sales in 2023 did ease relative to last year's peak, but with 27,416 sales, levels were still far higher than long-term trends and activity reported before the pandemic. While sales stayed relatively strong, there was a notable shift in activity toward more affordable apartment condominiums style homes.

“Higher lending rates dampened housing demand this year, but thanks to strong migration levels, housing demand remained relatively strong, especially for affordable options in our market,” said CREB® Chief Economist Ann-Marie Lurie. “At the same time, supply levels were low compared to the demand throughout the year, resulting in stronger than expected price growth.”

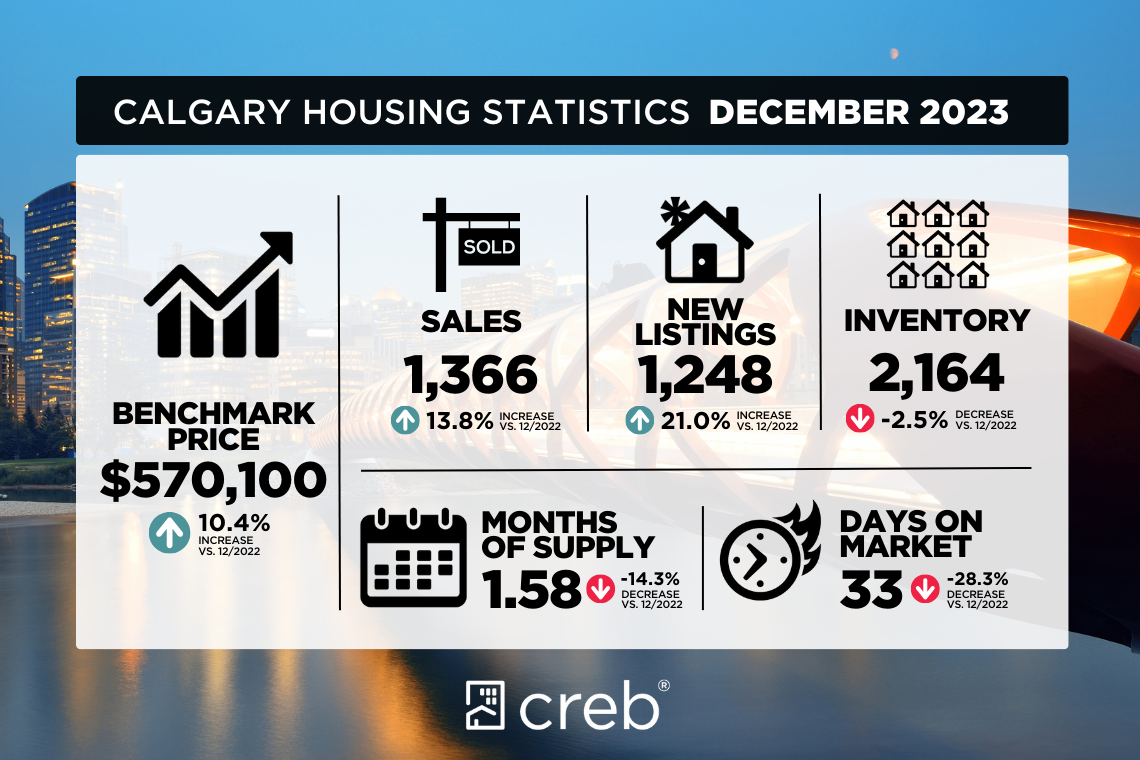

Inventory levels were persistently below long-term trends for the city throughout most of the year, averaging a 44 per cent decline over the 10-year average. We also saw the months of supply remain well below two months throughout most of the year across homes priced below $1,000,000.

The persistently tight conditions contributed to our city's new record high price. While the average annual benchmark price growth did slow from 12 per cent in 2022 to nearly six per cent growth in 2023, the price growth was still relatively strong especially compared to some markets in the country.

Detached

With an annual decline of nearly 20 per cent, the detached market saw the most significant decline in sales activity. While sales did improve for homes priced above $700,000, limited supply choices in the lower price ranges caused consumers to turn to alternative housing styles. Despite some recent gains in higher-priced new listings, inventories have remained near record lows, and the months of supply have remained relatively low throughout 2023.

The persistently tight market conditions have supported further price growth for detached homes, albeit at a slower pace than last year. On average, the benchmark price rose by nearly eight per cent in 2023, with the most significant gains occurring in the city's most affordable districts.

Like the detached sector, year-over-year sales growth since May was not enough to offset the pullbacks at the beginning of the year, leaving 2023 sales down by 10 per cent. The decline in sales was driven by pullbacks for homes priced under $500,000, while sales improved for higher-priced properties. The decline in the lower range was primarily due to limited supply choices, preventing stronger sales.

Persistently tight market conditions this year caused prices to trend up throughout most of the year. On an annual basis, the benchmark price rose by seven per cent over last year—a slower gain than the 12 per cent reported in 2022, but still relatively strong. Price growth ranged from a low of six per cent in the city centre to over 16 per cent in the east district.

Limited supply choices in the lower price ranges contributed to the pullback in sales in 2023. Annual sales declined by over 11 per cent despite rising sales for homes priced above $400,000. While new listings did show signs of improving in the second half of the year, all of the gains were reported in the higher price ranges, causing relatively more balanced conditions in the upper price ranges versus the sellers’ market conditions in the lower price ranges.

Conditions favoured the seller throughout the year, supporting an annual benchmark price gain of over 13 per cent. Prices improved across each district, ranging from a low of 11 per cent in the city centre to over 20 per cent price growth in both the North East and East districts.

Apartment-style properties were the only property type to report a gain in sales this year, resulting in a record high of 7,884. The growth in sales was possible thanks to the higher starting point for inventory levels and gains in new listings. However, conditions tightened throughout the year, favouring the seller and driving price growth.

Apartment condominium prices finally recovered from their 2014 high earlier this year and have pushed above those levels, reaching a new record high of $321,400 by December. On an annual basis, the 2023 benchmark price rose by over 13 per cent, a faster pace than the annual growth levels reported last year.

REGIONAL MARKET FACTS

Airdrie

Primarily due to pullbacks for detached homes, sales in Airdrie declined by 24 per cent over last year's record high. Low inventory levels and a pullback in new listings have somewhat limited sales. While new listings have risen over last year's levels for the past four months, they are still 24 per cent lower than last year. The decline in sales and new listings ensured inventories remained low this year, declining over last year’s and falling to the lowest annual average levels seen since 2006.

For the third year in a row, conditions in Airdrie have generally favoured the seller. This has driven further price gains this year, albeit at a slower pace. On an annual basis, the benchmark price rose by nearly five per cent. This year, the price growth for row and apartment-style properties has been more than double that reported in the detached and semi-detached sectors.

Cochrane

Both sales and new listings in Cochrane fell over last year’s levels. However, recent gains in new listings relative to sales did help support some inventory gains. While inventory levels have improved over the low levels reported last year, they remain over 40 per cent below what we traditionally see in the market.

The recent shifts in new listings relative to sales have helped the months of supply stay above two months since September. However, conditions are still relatively tight, and prices continue to rise. While the growth was stronger in the higher-density sectors of the market, the detached benchmark prices increased by four per cent in 2023 over last year.

Supply has been a challenge in Okotoks, impacting sales and prices. While we have seen some improvements lately regarding the level of new listings compared to sales, inventories have remained near record lows and averaged 63 per cent below long-term trends on an annual basis.

Conditions have remained relatively tight throughout most of the year, especially throughout the busier spring season. Despite some monthly variation, prices generally trended up this year and, on an annual basis, rose by over six per cent.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Discover more insights at CREB®'s Forecast Conference!

Uncover deeper insights into Calgary's housing market by attending the CREB® Forecast Conference on Jan. 23, 2024.

Our Chief Economist, Ann-Marie Lurie, will share exclusive trends and pivotal shifts in the market. This event is a must-attend for anyone seeking a comprehensive understanding of Calgary's real estate landscape.

Don't miss the opportunity to gain valuable knowledge and network with industry experts. Secure your spot now by visiting crebforecast.com.

Tagged: Statistics