Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - investment

Sept. 27, 2017 | Andrea Cox

No parking, no problem

Forty-somethings Sue and Jason Bissonnette love to travel and experience new things. They own vacation properties around the world, including a three-season recreation trailer at B.C.'s Moyie Lake and two timeshare properties in the Caribbean. When they're not travelling, they spend most of their time hanging out in Airdrie, where they own a two-storey, 2,000-square-foot home that they share with their two kids – a 19-year-old daughter and a 22-year-old son. Always on the lookout for new investment opportunities, the couple couldn't resist exploring the options when they were introduced to Knightsbridge Homes' N3 condominium project. They were attracted to its East Village location – steps away from the downtown core and the LRT – and the car-free lifestyle. A Car2Go membership, furniture package from Ikea and a Biria urban bicycle sweetened the deal. In the end, the Bissonnettes purchased a 498-square-foot, two-bedroom, one-bathroom condo on the 14th floor.

July 12, 2017 | Geoff Geddes

Farmland finance

Given the fickle Canadian climate, farming for a living is often viewed as a risky proposition. Buying farmland, however, is attracting some interest from Calgary investors seeking a hedge against inflation that will also produce goods and generate income.

The two most common ways to make money from farmland are capital appreciation – when the land increases in value - and income. That income can be from cash rent, calculated by dollars per cultivated acre, or a crop share, where the investor receives a share of the total crop sales each year, usually about 20-30 per cent.

"Farmland has been a tremendous investment over the last 10 years," said J.P. Gervais, chief agricultural economist for Farm Credit Canada. "Not only have land values been rising, but returns from farming have been very strong, with farm cash receipts increasing on a national level by an average of $2 billion a year for the past decade."

Jan. 28, 2017 | Andrea Cox

The Mountain Lifestyle

Starting this week, CREB®Now will be sitting down and talking with local homebuyers to understand why they bought, where they bought it and what advice they might have to others.

Jill Stephenson-Long and Chris Long fell in love with the mountain lifestyle 15 years ago when they moved to Canmore to begin their lives together and further their respective careers. The active, health-conscious and design-focused couple – she is a nurse and he is a chiropractor – have three young children: nine-year-old twins, a boy and girl, and a five-year-old son.

With the goal of eventually building their mountain-themed dream home over the years, the couple, purchased investment real estate and rental properties in Canmore to finance their down payment while they lived in a leased home, raising their young family.

April 29, 2016 | Cody Stuart

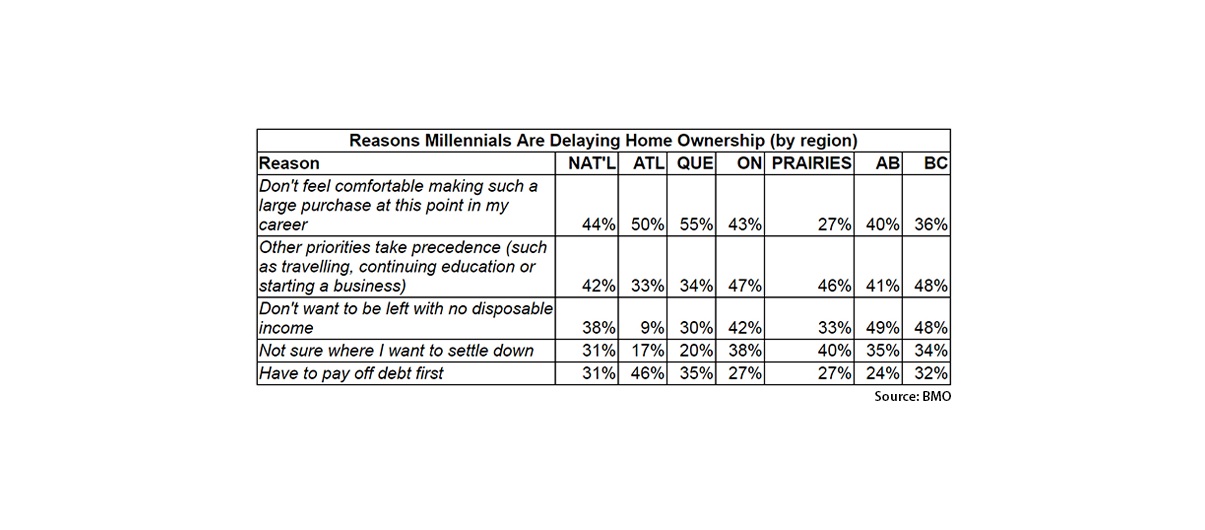

Rent-weary millennials not rushing into homeownership

Canadian housing prices continue to rise, but prospective millennial first-time homebuyers are in no rush to enter the market.

According to a report released by the Bank of Montreal, while 60 per cent of millennials surveyed are tired of paying rent, 70 per cent would rather delay homeownership until they can get what they really want in a home.

This comes at a time when millennials are expecting to pay more for their first homes than previous years, exceeding $350,000 on average nationally. That figure rises to more than $465,000 and $525,000 for Toronto and Vancouver respectively.

Dec. 12, 2015 | Cody Stuart

5 things about Canada's middle-class tax cut

$3.4 billion

With around nine million Canadians making between $45,282 and $90,563 set to see their tax bills decrease in 2016, the total cost to the Canadian government will be $3.4 billion. Single individuals who benefit will see an average tax reduction of $330 every year, and couples who benefit will see an average tax reduction of

$540 every year. The maximum tax reduction will be $679 per individual and $1,358 per couple.

Nov. 23, 2015 | Barb Livingstone

Experts warn against willing it away

What are Canadians, particularly the massive Baby Boomer generation, going to do with increasingly valuable real estate?

According to a new CIBC poll, many of them will be leaving assets, including recreational properties, to heirs in their wills.

And while it may be done with good intentions, Jamie Golombek, managing director of tax and estate planning for the bank's Wealth Advisory Services, says without proper planning, that real estate could end up on the housing market, as those heirs sell properties to deal with all sorts of tax issues.

Nov. 20, 2015 | Cody Stuart

Calgary shares

Share and share alike: for better or worse, it might be Calgary's new unofficial slogan.

Whether it's a home, room, or even a parking spot, Calgarians are proving to be big believers in divvying up their assets, with the controversial Uber car-sharing app and several other share-based service-providers gaining footholds in the local market.

Yet despite offering revenue-generating opportunities, services like AirBnB and Uber, also present some risks to providers, warn legal experts.

June 25, 2015 | Nolan Matthias

Calgary market remains great investment

It appears as though Calgary real estate will continue to be a great investment for investors looking to become landlords.

It appears as though Calgary real estate will continue to be a great investment for investors looking to become landlords.This week the Alberta government quelled fears of impending rent controls, signaling the market will continue to support investment real estate as a method of wealth accumulation.

May 06, 2015 | Nolan Matthias

Real estate investment still favourable in Calgary

The perfect storm for long-term real estate investing in Calgary continues to build steam despite low oil prices and fear mongering by industry naysayers.

The perfect storm for long-term real estate investing in Calgary continues to build steam despite low oil prices and fear mongering by industry naysayers.In fact, the six market rules Mortgage360 talks about in its Cash Flow Club meetings – which cover market vacancy rates, employment, rental rates and net migration – are still being met, even though some would have you believe the proverbial real estate sky is falling.

March 11, 2015 | CREBNow

Despite sensationalism, Calgary still a great investment

Despite media headlines and continued sensationalism from economists both domestic and foreign, Calgary continues to be one of the best places for real estate investment in Canada.

Despite media headlines and continued sensationalism from economists both domestic and foreign, Calgary continues to be one of the best places for real estate investment in Canada.Here are five reasons why:

Vacancy rates remain low: According to the fall 2014 edition of the CMHC Housing Market Outlook for Calgary, vacancy rates remain low at 1.4 per cent and are not expected to exceed 1.8 per cent in either 2015 or 2016. Vacancy rates are deemed favourable for real estate investment when they are below five per cent.