Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - first time homebuyers

News

June 30, 2016 | Mario Toneguzzi

Perfect match

Buyers, sellers encouraged to do their research before picking a real estate professional

Purchasing a home will be one of the biggest financial decisions most of us will ever make in our lifetimes. Getting it right can mean the difference between moving into your dream home and living in a house of horrors.

Whether a first-time buyer/seller or not, the first step is to find the right real estate professional or service to help you on your journey to homeownership, said CREB® president Cliff Stevenson. A good place to start is through referral.

"If there was an analysis done on the largest referral source, it's probably from people you know and come across. It's word-of-mouth referral," said Stevenson, adding online searches are also important tools for buyers and sellers when looking for a real estate professional or service. "But they're looking for some type of social proof and social validation out there as well."

Purchasing a home will be one of the biggest financial decisions most of us will ever make in our lifetimes. Getting it right can mean the difference between moving into your dream home and living in a house of horrors.

Whether a first-time buyer/seller or not, the first step is to find the right real estate professional or service to help you on your journey to homeownership, said CREB® president Cliff Stevenson. A good place to start is through referral.

"If there was an analysis done on the largest referral source, it's probably from people you know and come across. It's word-of-mouth referral," said Stevenson, adding online searches are also important tools for buyers and sellers when looking for a real estate professional or service. "But they're looking for some type of social proof and social validation out there as well."

News

June 30, 2016 | Barb Livingstone

Picking the perfect community

Urban planning experts offer tips on how to shop for your next neighbourhood

Is it a neighbourhood with a lake so you don't need a vacation cottage?

Or an upgraded, older neighbourhood with lots of housing choices?

Perhaps a community with a main street so "you don't have to jump in your car to get a quart of milk?"

When urban commentators weigh in on what homebuyers, first-time or otherwise, should be looking for when they chose a place to live the emphasis is on community amenities – or as Greg Morrow puts it, looking "outside the four walls" of the home, to the DNA of the neighbourhood.

Is it a neighbourhood with a lake so you don't need a vacation cottage?

Or an upgraded, older neighbourhood with lots of housing choices?

Perhaps a community with a main street so "you don't have to jump in your car to get a quart of milk?"

When urban commentators weigh in on what homebuyers, first-time or otherwise, should be looking for when they chose a place to live the emphasis is on community amenities – or as Greg Morrow puts it, looking "outside the four walls" of the home, to the DNA of the neighbourhood.

News

June 24, 2016 | Marty Hope

Taking the plunge

Calgary couple's research, timing pays off during first home purchase

Booker and Lisa Zaytsoff didn't take the plunge into homeownership lightly.

About a year ago, the young couple started to investigate the marketplace, getting a read on what was happening – all the while putting away money for a down payment.

"Finally, we had enough saved up so decided to buy — something that, for us, had always been in the cards," said Booker. "What was important for us was location and price. The fact mortgage rates were low was a bonus."

Booker and Lisa Zaytsoff didn't take the plunge into homeownership lightly.

About a year ago, the young couple started to investigate the marketplace, getting a read on what was happening – all the while putting away money for a down payment.

"Finally, we had enough saved up so decided to buy — something that, for us, had always been in the cards," said Booker. "What was important for us was location and price. The fact mortgage rates were low was a bonus."

News

June 02, 2016 | Cailynn Klingbeil

55 Years of Real Estate: 1993 CREB® president Ellyn Mendham

Ellyn Mendham credits teaching background to industry leadership

Ellyn Mendham describes her entry into real estate as a "fluke."

Originally an elementary school teacher in Philadelphia, then Nova Scotia, Mendham's credentials did not immediately transfer when she moved to Alberta.

"I needed to work and produce an income, and at the time I thought I would go back to teaching later," said Mendham. "By fluke, I got into real estate."

But after making her first sale – a home that went for $42,000 in 1975 – she quickly realized she loved the industry.

Ellyn Mendham describes her entry into real estate as a "fluke."

Originally an elementary school teacher in Philadelphia, then Nova Scotia, Mendham's credentials did not immediately transfer when she moved to Alberta.

"I needed to work and produce an income, and at the time I thought I would go back to teaching later," said Mendham. "By fluke, I got into real estate."

But after making her first sale – a home that went for $42,000 in 1975 – she quickly realized she loved the industry.

News

April 29, 2016 | Cody Stuart

Rent-weary millennials not rushing into homeownership

BMO study says generation is still willing to wait

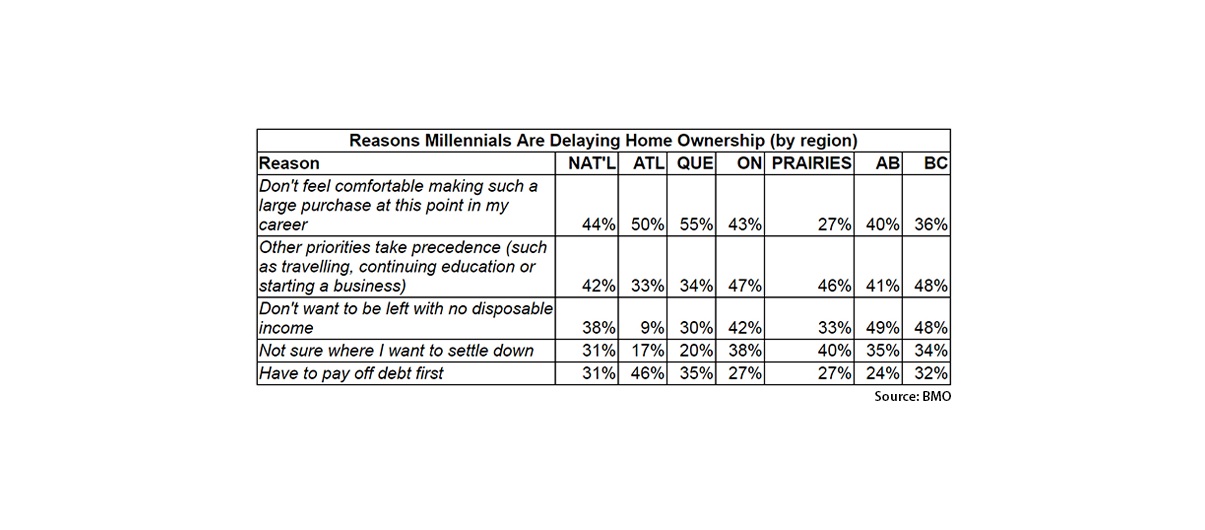

Canadian housing prices continue to rise, but prospective millennial first-time homebuyers are in no rush to enter the market.

According to a report released by the Bank of Montreal, while 60 per cent of millennials surveyed are tired of paying rent, 70 per cent would rather delay homeownership until they can get what they really want in a home.

This comes at a time when millennials are expecting to pay more for their first homes than previous years, exceeding $350,000 on average nationally. That figure rises to more than $465,000 and $525,000 for Toronto and Vancouver respectively.

Canadian housing prices continue to rise, but prospective millennial first-time homebuyers are in no rush to enter the market.

According to a report released by the Bank of Montreal, while 60 per cent of millennials surveyed are tired of paying rent, 70 per cent would rather delay homeownership until they can get what they really want in a home.

This comes at a time when millennials are expecting to pay more for their first homes than previous years, exceeding $350,000 on average nationally. That figure rises to more than $465,000 and $525,000 for Toronto and Vancouver respectively.