Calgary's trusted source of real estate news, advice and statistics since 1983.

Aug. 23, 2017 | Mario Toneguzzi

Come on in

Open houses remain a valid and valuable way to sell properties, even in this day and age of virtual reality.

While the technological tools available today to give maximum exposure to a listing have made it easier for potential homebuyers to window shop from anywhere, the physical presence of an open house still can't be replaced.

CREB® president David P. Brown says opinions about open houses are often divided. Some REALTORS® love them, while others can't stand them.

"But how we do it has changed a fair bit I believe," said Brown. "Social media has got to be the biggest thing. Before, if we were going to have an open house we might hand deliver a few flyers or something around the neighbourhood – put up some signs and that was it.

"Now, we post it all over."

Aug. 10, 2017 | Kathleen Renne

Defining luxury

Opulence, extravagance, and splendour are words typically used to describe homes of the rich and famous. Those words also apply to Calgary with its fair share of what are considered luxury dwellings.

Aug. 23, 2017 | Geoff Geddes

Future leaders

While interest accruing on a mortgage balance is rarely a welcome sight, the growing interest in the Westman Centre for Real Estate Studies at the University of Calgary is a different story.

Part of the Haskayne School of Business, the Westman Centre was founded in 2012 with $7.6 million in funding from the real estate industry, which included a $5 million endowment from Jay Westman. Its mission is to be a catalyst for the development of real estate professionals and a leading centre of excellence for real estate studies through its teaching, research and community engagement activities.

"Industry saw a need for a program where graduates would have a firm grasp of the real estate sector and the career opportunities it could offer," said Jessica Abt, the centre's director.

Aug. 10, 2017 | Tyler Difley

Look of luxury

While many people have grand aspirations when it comes to the aesthetic of their home, not everyone has the money to pay for a beautifully designed luxury home or a series of expensive renovations. Thankfully, there are a number of quick and easy ways to achieve a luxurious look in any room without the luxury price tag.

Aug. 16, 2017 | CREBNow

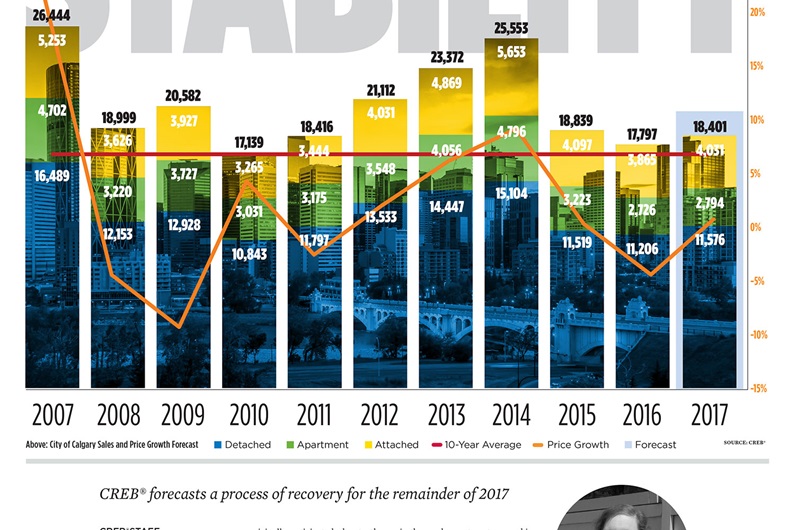

Mid-year market update shows stability

The first-half of 2017 marked a shift in Alberta's economy from recession to recovery, with conditions supporting stability rather than expansion.

"Economic challenges continue to exist, as high unemployment rates, weak migration levels and more stringent lending conditions are weighing on the housing market," said CREB® chief economist Ann-Marie Lurie.

"This will continue to cause some adjustments in the housing market for the remainder of this year. However, this is not expected to offset earlier gains supporting general stability in 2017."

Aug. 30, 2017 | Kathleen Renne

No slowing down

Dorothy Baker, 92, is perched on the edge of a chair in an elegant sitting room in Lake Bonavista Village Retirement Residence, her neon-pink toenails poking out from a pair of white sandals. A resident of Lake Bonavista Village for the past eight years, Baker exemplifies the modern senior: someone who is active, engaged and often busier than those folks still working the nine-to-five grind. She's the treasurer of Lake Bonavista Village's knitting club, she organizes bridge games for residents, and she serves as one of the village's welcome hostesses for newcomers to its population of more than 200 residents.

Aug. 23, 2017 | Kathleen Renne

Post-secondary appeal

Bob Benson fondly recalls many a Bermuda Shorts Day – the University of Calgary's annual end-of-academic-year celebration – at the Benson home in the northwest community of Varsity.

"We'd host a Bermuda Shorts Day breakfast with ham and pancakes. Kids would congregate at our place at 8:30 a.m. or 9 a.m. and then head over to the university," said Benson, adding he and his wife moved to Varsity in 1988 with the hope that the community's proximity to the university would make it easier for his four children to attend. Apparently, it worked – three of Benson's children studied there.

Varsity is one of several Calgary communities that borders a post-secondary institution. That proximity comes with all the pros, and the occasional con, of living near a large body of students.

Aug. 30, 2017 | Geoff Geddes

The upside of downsizing

When it comes to choosing a home later in life, age often brings thoughtful consideration of what really matters. More and more in Calgary, that wisdom is leading seniors to choose condominiums as the place to live out their golden years.

"Five years ago, when we tracked inner-city demographics, you saw maybe 1-2 per cent of seniors purchasing condos," said Oliver Trutina, vice-president of Calgary-based builder Truman.

"Today, that number is around 20 per cent. Since this is often their third or fourth home purchase, they know what they want and are asking for it."

Aug. 02, 2017 | Andrea Cox

Affordable core

Joshua Smith, a 31-year-old communications adviser, was living in the northeast community of Taradale with his brother, commuting close to two hours a day to his job in the downtown core and back. His goal was to save some money and purchase a condo in the inner city. He yearned for the downtown lifestyle, where he could be close to coffee shops, restaurants and workout facilities. He wanted to be able to walk to work, and to meet friends for dinner or drinks without having to worry about a lengthy drive or an expensive cab fare. He also required a home with a great view, and it had to be affordable.

Aug. 30, 2017 | Gerald Vander Pyl

Growing closer

When Lynn MacCallum helped out with the Cliff Bungalow Community Garden during its construction in 2014, it was with a view towards having some garden space of her own.

"We are in a condo, and like many people in the neighbourhood, we didn't have access to growing food in our own gardens," said MacCallum. "I think a lot of people in the garden live in an apartment, so other than growing a couple of herbs in a pot on a balcony, there wasn't much opportunity.

"Growing food was foremost, but what has happened is this community that has been created, which is pretty awesome."