Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - BMO

News

June 24, 2016 | Paula Trotter

Do you understand your options?

Understanding different mortgage options

Fixed versus variable; closed versus open; payment frequency: When it comes to picking a mortgage, do you know what's best for you?

BMO mortgage specialist Laura Parsons offers her insights.

Fixed versus variable interest rate

A variable rate will fluctuate with prime – meaning you could end up paying more interest if prime changes. A fixed rate will not fluctuate.

Fixed versus variable; closed versus open; payment frequency: When it comes to picking a mortgage, do you know what's best for you?

BMO mortgage specialist Laura Parsons offers her insights.

Fixed versus variable interest rate

A variable rate will fluctuate with prime – meaning you could end up paying more interest if prime changes. A fixed rate will not fluctuate.

News

June 24, 2016 | Paula Trotter

The ABCs of your first mortgage

BMO specialist Laura Parsons highlights often-overlooked programs for first-time buyers

Price is the deciding factor for many young adults who are purchasing their first home.

This isn't necessarily a bad thing; but you actually risk taking a financial hit when you fixate solely on what you think you can afford, said BMO mortgage specialist Laura Parsons.

"Millennials tend to migrate to affordability instead of understanding their options," said Parsons, who has more than 30 years of mortgage experience.

Price is the deciding factor for many young adults who are purchasing their first home.

This isn't necessarily a bad thing; but you actually risk taking a financial hit when you fixate solely on what you think you can afford, said BMO mortgage specialist Laura Parsons.

"Millennials tend to migrate to affordability instead of understanding their options," said Parsons, who has more than 30 years of mortgage experience.

News

April 29, 2016 | Cody Stuart

Rent-weary millennials not rushing into homeownership

BMO study says generation is still willing to wait

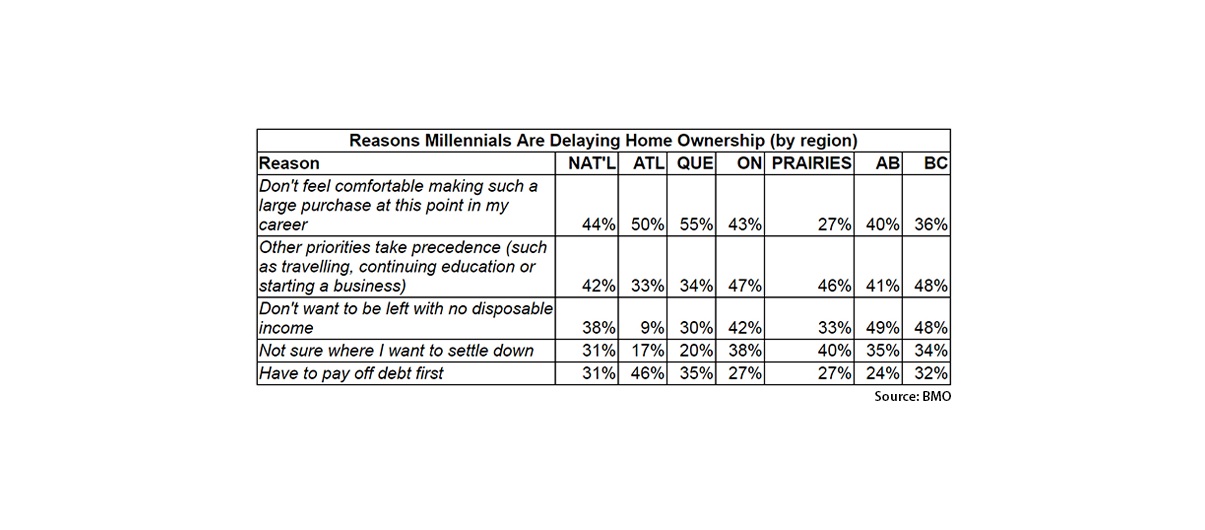

Canadian housing prices continue to rise, but prospective millennial first-time homebuyers are in no rush to enter the market.

According to a report released by the Bank of Montreal, while 60 per cent of millennials surveyed are tired of paying rent, 70 per cent would rather delay homeownership until they can get what they really want in a home.

This comes at a time when millennials are expecting to pay more for their first homes than previous years, exceeding $350,000 on average nationally. That figure rises to more than $465,000 and $525,000 for Toronto and Vancouver respectively.

Canadian housing prices continue to rise, but prospective millennial first-time homebuyers are in no rush to enter the market.

According to a report released by the Bank of Montreal, while 60 per cent of millennials surveyed are tired of paying rent, 70 per cent would rather delay homeownership until they can get what they really want in a home.

This comes at a time when millennials are expecting to pay more for their first homes than previous years, exceeding $350,000 on average nationally. That figure rises to more than $465,000 and $525,000 for Toronto and Vancouver respectively.

News

Jan. 29, 2016 | Cody Stuart

Interest-ing times

Bank of Canada's overnight lending rate exposes disparities in Canada's housing markets

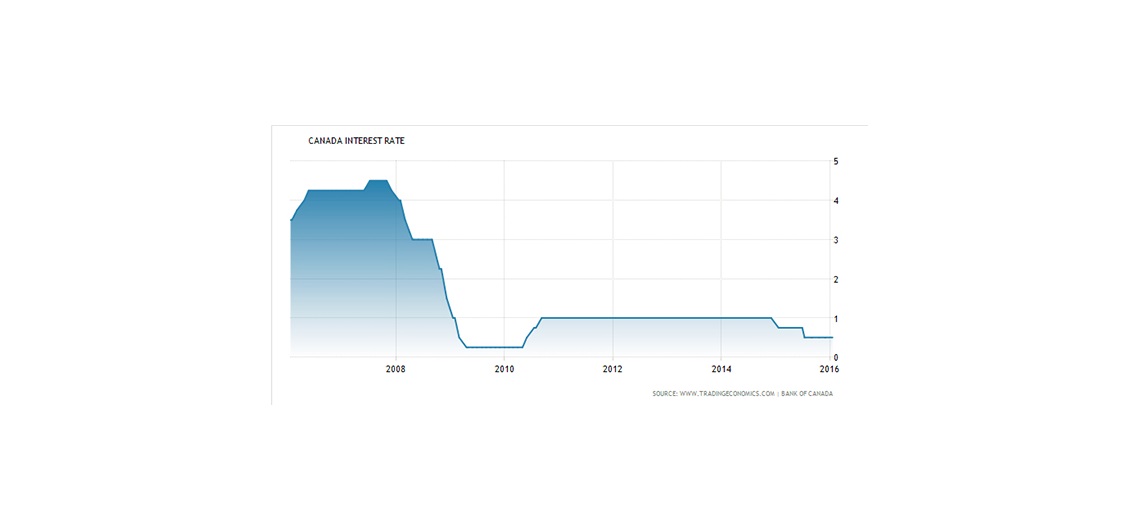

The Bank of Canada's decision to leave its overnight lending rate unchanged at 0.5 per cent is expected to have vastly different impacts on markets across the country, say experts.

The bank's decision to stand pat on the rate it established last July instead of downgrading it by 0.25 per cent will do little to help revive what's expected to be a sluggish economy in 2016, said BMO Financial Group chief economist Douglas Porter in an interview with CREB®Now.

"It's certainly not going to be enough to turn around Calgary," he said. "Is it enough to revive the Canadian economy? No, a quarter point is not going to do it. But there's only so much a central bank can do without risking other things, and I think we've seen those risks in the past year."

The Bank of Canada's decision to leave its overnight lending rate unchanged at 0.5 per cent is expected to have vastly different impacts on markets across the country, say experts.

The bank's decision to stand pat on the rate it established last July instead of downgrading it by 0.25 per cent will do little to help revive what's expected to be a sluggish economy in 2016, said BMO Financial Group chief economist Douglas Porter in an interview with CREB®Now.

"It's certainly not going to be enough to turn around Calgary," he said. "Is it enough to revive the Canadian economy? No, a quarter point is not going to do it. But there's only so much a central bank can do without risking other things, and I think we've seen those risks in the past year."

News

June 03, 2015 | CREBNow

PTQ: Laura Parsons

Calgary Area Manager for Mortgage Specialists with BMO

Laura Parsons is the Calgary area manager for mortgage specialists with Bank of Montreal. She recently took some time to chat with CREBNow about how oil prices have affected the lending market, what borrowers should know about low rates and what the Calgary Stampede means to the city.

Laura Parsons is the Calgary area manager for mortgage specialists with Bank of Montreal. She recently took some time to chat with CREBNow about how oil prices have affected the lending market, what borrowers should know about low rates and what the Calgary Stampede means to the city.

News

April 30, 2015 | Nolan Matthias

Traditional mortgages: more than meets the eye

Devil's in the details*

The myth that all mortgages are created equal is slowly unraveling.

The myth that all mortgages are created equal is slowly unraveling.

In fact, when it comes to mortgages, one of the only things Canada's big banks can seemingly agree on is the interest rate. Everything else varies significantly between them.

Consumers, in turn, are slowly starting to figure out every bank has its own idiosyncrasies that may not be immediately apparent.

The myth that all mortgages are created equal is slowly unraveling.

The myth that all mortgages are created equal is slowly unraveling.In fact, when it comes to mortgages, one of the only things Canada's big banks can seemingly agree on is the interest rate. Everything else varies significantly between them.

Consumers, in turn, are slowly starting to figure out every bank has its own idiosyncrasies that may not be immediately apparent.

News

May 13, 2014 | CREBNow

Alberta economy outshines rest of Canada

Alberta's economy is expected to grow by 3.5 per cent this year, nearly triple the national average of 1.2 per cent, according to a recent report from BMO Capital Markets Economics and BMO Commercial Banking's Blue Book.

The continued positive outlook is largely due to the province's energy sector and related industries.

"Oil and gas companies still dominate the scene, but we see significant opportunity for firms that support the industry spinoffs," said Mike Darling, BMO's regional vice-president of commercial banking for southern Alberta. "This particularly applies to the engineering sector, where our clients are experiencing considerable growth."

The continued positive outlook is largely due to the province's energy sector and related industries.

"Oil and gas companies still dominate the scene, but we see significant opportunity for firms that support the industry spinoffs," said Mike Darling, BMO's regional vice-president of commercial banking for southern Alberta. "This particularly applies to the engineering sector, where our clients are experiencing considerable growth."