Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - Mortgage 360

News

Jan. 29, 2016 | Cody Stuart

Interest-ing times

Bank of Canada's overnight lending rate exposes disparities in Canada's housing markets

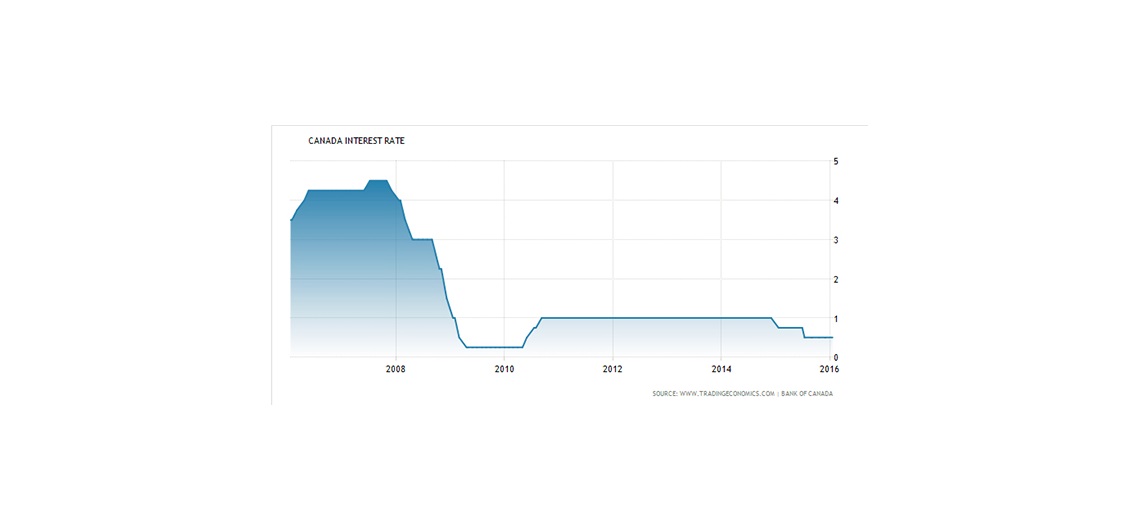

The Bank of Canada's decision to leave its overnight lending rate unchanged at 0.5 per cent is expected to have vastly different impacts on markets across the country, say experts.

The bank's decision to stand pat on the rate it established last July instead of downgrading it by 0.25 per cent will do little to help revive what's expected to be a sluggish economy in 2016, said BMO Financial Group chief economist Douglas Porter in an interview with CREB®Now.

"It's certainly not going to be enough to turn around Calgary," he said. "Is it enough to revive the Canadian economy? No, a quarter point is not going to do it. But there's only so much a central bank can do without risking other things, and I think we've seen those risks in the past year."

The Bank of Canada's decision to leave its overnight lending rate unchanged at 0.5 per cent is expected to have vastly different impacts on markets across the country, say experts.

The bank's decision to stand pat on the rate it established last July instead of downgrading it by 0.25 per cent will do little to help revive what's expected to be a sluggish economy in 2016, said BMO Financial Group chief economist Douglas Porter in an interview with CREB®Now.

"It's certainly not going to be enough to turn around Calgary," he said. "Is it enough to revive the Canadian economy? No, a quarter point is not going to do it. But there's only so much a central bank can do without risking other things, and I think we've seen those risks in the past year."

News

June 10, 2015 | CREBNow

Looking beyond variable mortgages

Short-term fixed re-emerging as alternative

Variable rates are back in fashion after the Bank of Canada lowered the overnight lending rate in January, and economists expect another decrease in the near future.

Variable rates are back in fashion after the Bank of Canada lowered the overnight lending rate in January, and economists expect another decrease in the near future.

Yet, even though variable rates make sense, most borrowers are still leaning toward fixed-rate mortgages for no reason other than certainty. Consumers like to know what their mortgage rate is going to be.

The good news is there are options for risk-averse borrowers who don't want to dive into the variable-rate waters, but still want the low rates that come with the floating products.

Variable rates are back in fashion after the Bank of Canada lowered the overnight lending rate in January, and economists expect another decrease in the near future.

Variable rates are back in fashion after the Bank of Canada lowered the overnight lending rate in January, and economists expect another decrease in the near future.Yet, even though variable rates make sense, most borrowers are still leaning toward fixed-rate mortgages for no reason other than certainty. Consumers like to know what their mortgage rate is going to be.

The good news is there are options for risk-averse borrowers who don't want to dive into the variable-rate waters, but still want the low rates that come with the floating products.

News

May 26, 2015 | Nolan Matthias

Mortgage misconceptions

Why interest rates are not the only consideration

The common misconception is all mortgages are created equal – the only piece you have to pay attention to is the interest rate.

The common misconception is all mortgages are created equal – the only piece you have to pay attention to is the interest rate.

That couldn't be further than the truth.

In fact, if you consider the mortgages of the five big bank – RBC, BMO, TD Canada Trust, Scotiabank and CIBC – the only commonality is the interest rate. The 20 or so pages that make up the rest of the mortgage document are completely different.

News

Dec. 03, 2014 | Nolan Matthias

Three simple rules for revenue properties

There's more to it than just buying a condo

In last week's column, I discussed a client who recently purchased a rental property that will return 17 per cent annually on just the cash flow and mortgage repayment.

In last week's column, I discussed a client who recently purchased a rental property that will return 17 per cent annually on just the cash flow and mortgage repayment.

That's a pretty good return, especially when considering that return will increase as more principal is paid down, and as the property starts to appreciate in value.

However, there is more to consider than just buying a condo and renting it out. Our client is a smart buyer who followed three basic rules when it came to buying her investment property. While these rules are simple, they are also important.

In last week's column, I discussed a client who recently purchased a rental property that will return 17 per cent annually on just the cash flow and mortgage repayment.

In last week's column, I discussed a client who recently purchased a rental property that will return 17 per cent annually on just the cash flow and mortgage repayment.That's a pretty good return, especially when considering that return will increase as more principal is paid down, and as the property starts to appreciate in value.

However, there is more to consider than just buying a condo and renting it out. Our client is a smart buyer who followed three basic rules when it came to buying her investment property. While these rules are simple, they are also important.

News

Nov. 13, 2014 | Nolan Matthias

Don't overlook payment privileges

Understanding how they affect rates, penalties

Pre-payment privileges are the single-most overlooked aspect of a mortgage by borrowers. Consumers, for whatever reason, seem to gloss over them as if they are a feature of the mortgage that will never be used.

Pre-payment privileges are the single-most overlooked aspect of a mortgage by borrowers. Consumers, for whatever reason, seem to gloss over them as if they are a feature of the mortgage that will never be used.

However, pre-payment privileges are important. They are what allow a borrower to reduce his or her amortization from 25 years to 10 years. They can also affect interest rates and payout penalties, which is why a better understanding of how they work, is important.

Pre-payment privileges are the single-most overlooked aspect of a mortgage by borrowers. Consumers, for whatever reason, seem to gloss over them as if they are a feature of the mortgage that will never be used.

Pre-payment privileges are the single-most overlooked aspect of a mortgage by borrowers. Consumers, for whatever reason, seem to gloss over them as if they are a feature of the mortgage that will never be used.However, pre-payment privileges are important. They are what allow a borrower to reduce his or her amortization from 25 years to 10 years. They can also affect interest rates and payout penalties, which is why a better understanding of how they work, is important.

News

Oct. 07, 2014 | Nolan Matthias

The benefits of owning versus renting

'Don't pay off someone else's mortgage'

Many of us remember our parents telling us it is better to own a home than rent one at some point in time – "don't pay off someone else's mortgage," they'd say.

They could not have been more correct.

So why are many people still choosing to rent when owning a property can be so financially rewarding?

Many of us remember our parents telling us it is better to own a home than rent one at some point in time – "don't pay off someone else's mortgage," they'd say.

They could not have been more correct.

So why are many people still choosing to rent when owning a property can be so financially rewarding?