Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - lending rate

News

Jan. 29, 2016 | Cody Stuart

Interest-ing times

Bank of Canada's overnight lending rate exposes disparities in Canada's housing markets

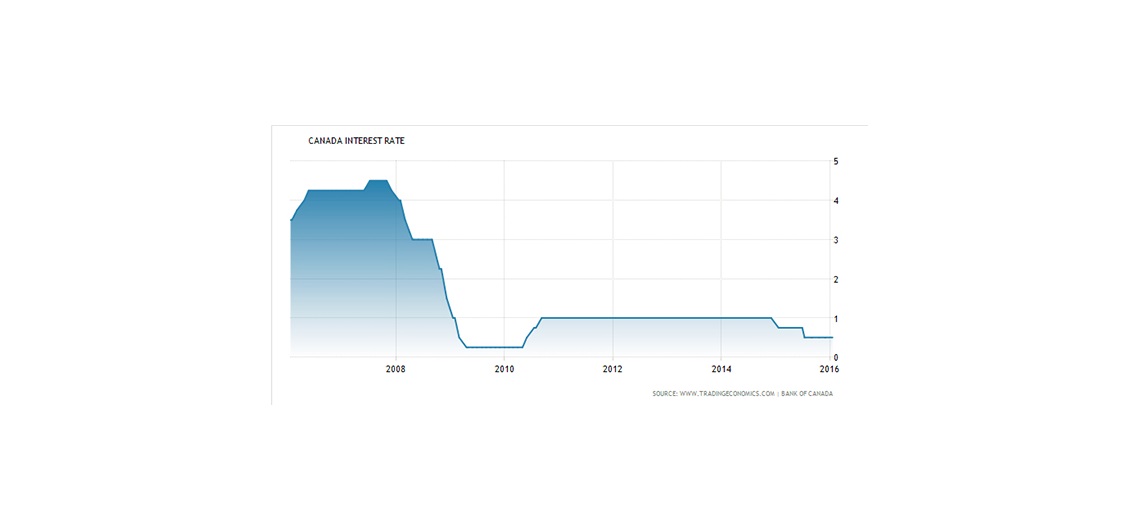

The Bank of Canada's decision to leave its overnight lending rate unchanged at 0.5 per cent is expected to have vastly different impacts on markets across the country, say experts.

The bank's decision to stand pat on the rate it established last July instead of downgrading it by 0.25 per cent will do little to help revive what's expected to be a sluggish economy in 2016, said BMO Financial Group chief economist Douglas Porter in an interview with CREB®Now.

"It's certainly not going to be enough to turn around Calgary," he said. "Is it enough to revive the Canadian economy? No, a quarter point is not going to do it. But there's only so much a central bank can do without risking other things, and I think we've seen those risks in the past year."

The Bank of Canada's decision to leave its overnight lending rate unchanged at 0.5 per cent is expected to have vastly different impacts on markets across the country, say experts.

The bank's decision to stand pat on the rate it established last July instead of downgrading it by 0.25 per cent will do little to help revive what's expected to be a sluggish economy in 2016, said BMO Financial Group chief economist Douglas Porter in an interview with CREB®Now.

"It's certainly not going to be enough to turn around Calgary," he said. "Is it enough to revive the Canadian economy? No, a quarter point is not going to do it. But there's only so much a central bank can do without risking other things, and I think we've seen those risks in the past year."

News

Jan. 28, 2016 | CREBNow

5 things about the Bank of Canada's overnight rate

By the numbers

Canada's central bank carries out monetary policy by influencing short-term interest rates. It does this by raising and lowering the target for the overnight rate, which is the interest rate at which major financial institutions borrow and lend one-day (or "overnight") funds among themselves. Not surprisingly, the overnight rate has a strong impact on the rates Canadians get from their lending institutions when they save or borrow money.

To help the average Canadian get a better grasp on the overnight lending rate, CREB®Now presents some of the key numbers.

Canada's central bank carries out monetary policy by influencing short-term interest rates. It does this by raising and lowering the target for the overnight rate, which is the interest rate at which major financial institutions borrow and lend one-day (or "overnight") funds among themselves. Not surprisingly, the overnight rate has a strong impact on the rates Canadians get from their lending institutions when they save or borrow money.

To help the average Canadian get a better grasp on the overnight lending rate, CREB®Now presents some of the key numbers.

News

Sept. 09, 2015 | Cody Stuart

5 things about the economy: ATB's Todd Hirsch

ATB Financial chief economist Todd Hirsch recently spoke at CREB® to outline some of his predictions for Alberta in 2016. During the talk, Hirsch discussed some causes for the current state of the provincial economy and factors that will need to change before Albertans see a rosier economic picture. CREB®Now examines some of the main talking points discussed during his visit.

Earnings:

Rather than simply pointing out the decline in the price of oil, Hirsch focused on the wages being earned by some Albertans as one of the factors affecting Alberta's current situation. Playing a massive role in province's employment picture, the average weekly earnings for Albertans had improved by 48 per cent over the last 10 years compared to 29 per cent nationally, with workers in the energy sector taking home 56 per cent more than a decade ago.

Earnings:

Rather than simply pointing out the decline in the price of oil, Hirsch focused on the wages being earned by some Albertans as one of the factors affecting Alberta's current situation. Playing a massive role in province's employment picture, the average weekly earnings for Albertans had improved by 48 per cent over the last 10 years compared to 29 per cent nationally, with workers in the energy sector taking home 56 per cent more than a decade ago.