Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - housing

News

Feb. 05, 2016 |

Timing the market

Housing stats indicate some buyers still sitting on the sidelines

Calgary's resale residential housing market picked up where it left off in 2015, with buyers' conditions prevailing through every major category last month, according to CREB®.

Yet with many homebuyers still sitting on the fence, local housing officials caution that historically it's been difficult to find a utopian moment to enter the market.

"Buyers, especially first-time buyers and investors, will do their best to time the bottom, but I think that will be really difficult," said CREB® president Cliff Stevenson, noting that few were able to do so during the last recession in 2008/09 when the upturn happened quickly. "I think this year it will be a guessing game as to when will be the best time to get into the market."

Calgary's resale residential housing market picked up where it left off in 2015, with buyers' conditions prevailing through every major category last month, according to CREB®.

Yet with many homebuyers still sitting on the fence, local housing officials caution that historically it's been difficult to find a utopian moment to enter the market.

"Buyers, especially first-time buyers and investors, will do their best to time the bottom, but I think that will be really difficult," said CREB® president Cliff Stevenson, noting that few were able to do so during the last recession in 2008/09 when the upturn happened quickly. "I think this year it will be a guessing game as to when will be the best time to get into the market."

News

Jan. 29, 2016 | Cody Stuart

Interest-ing times

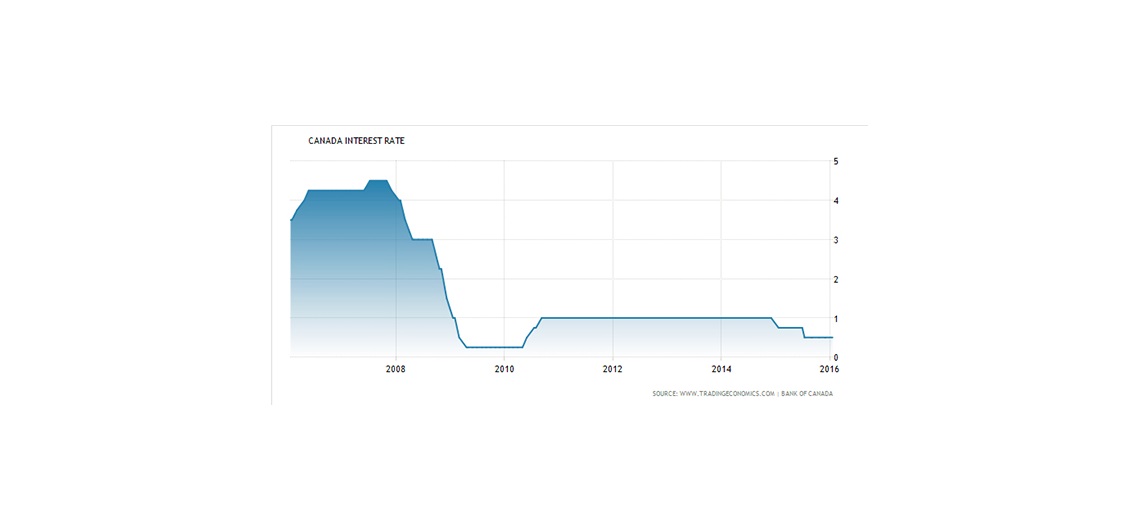

Bank of Canada's overnight lending rate exposes disparities in Canada's housing markets

The Bank of Canada's decision to leave its overnight lending rate unchanged at 0.5 per cent is expected to have vastly different impacts on markets across the country, say experts.

The bank's decision to stand pat on the rate it established last July instead of downgrading it by 0.25 per cent will do little to help revive what's expected to be a sluggish economy in 2016, said BMO Financial Group chief economist Douglas Porter in an interview with CREB®Now.

"It's certainly not going to be enough to turn around Calgary," he said. "Is it enough to revive the Canadian economy? No, a quarter point is not going to do it. But there's only so much a central bank can do without risking other things, and I think we've seen those risks in the past year."

The Bank of Canada's decision to leave its overnight lending rate unchanged at 0.5 per cent is expected to have vastly different impacts on markets across the country, say experts.

The bank's decision to stand pat on the rate it established last July instead of downgrading it by 0.25 per cent will do little to help revive what's expected to be a sluggish economy in 2016, said BMO Financial Group chief economist Douglas Porter in an interview with CREB®Now.

"It's certainly not going to be enough to turn around Calgary," he said. "Is it enough to revive the Canadian economy? No, a quarter point is not going to do it. But there's only so much a central bank can do without risking other things, and I think we've seen those risks in the past year."

News

Jan. 22, 2016 | Cody Stuart

Suite separation

Highland Park president says lack of communication complicating secondary suites issue

A local community association president says a lack of consultation by at least one member of council is adding to the disconnect between Calgary residents in support of the suites and those on city council who have voted against wider approval.

Highland Park Community Association president Elise Bieche said despite a "large" majority of those in her Ward 4 community who support the suites, Ward 4 Coun. Sean Chu hasn't contacted anyone with the association to gauge their opinion.

"I don't think he's ever surveyed Highland Park. That would be my guess," she said. "Sean has never asked me my opinion on secondary suites or my board's opinion, because my board has actually endorsed our stance on secondary suites. So it's not as though I've gone rogue or there's a disconnect between me and how my community feels on secondary suites."

A local community association president says a lack of consultation by at least one member of council is adding to the disconnect between Calgary residents in support of the suites and those on city council who have voted against wider approval.

Highland Park Community Association president Elise Bieche said despite a "large" majority of those in her Ward 4 community who support the suites, Ward 4 Coun. Sean Chu hasn't contacted anyone with the association to gauge their opinion.

"I don't think he's ever surveyed Highland Park. That would be my guess," she said. "Sean has never asked me my opinion on secondary suites or my board's opinion, because my board has actually endorsed our stance on secondary suites. So it's not as though I've gone rogue or there's a disconnect between me and how my community feels on secondary suites."

News

Dec. 07, 2015 | Cody Stuart

'Suite' opportunities in detached sector?

Regulation changes could make investment market more attractive

Recent changes to secondary suite regulations could spell good news for investors looking for opportunities in Calgary's detached housing sector.

In late November, city council voted to relax the regulations on lot size and increase the amount of floor space allowed in the suites.

Under the new rules, homes zoned R-C1Ls, R-C1s and R-1s will have the minimum lot width removed altogether, while homes zoned R-C1N, R-C2, R-1N and R-2 l will see the minimum lot width reduced to nine metres.

The changes will also increase the maximum size on basement suites from 75 to 100 square metres.

Recent changes to secondary suite regulations could spell good news for investors looking for opportunities in Calgary's detached housing sector.

In late November, city council voted to relax the regulations on lot size and increase the amount of floor space allowed in the suites.

Under the new rules, homes zoned R-C1Ls, R-C1s and R-1s will have the minimum lot width removed altogether, while homes zoned R-C1N, R-C2, R-1N and R-2 l will see the minimum lot width reduced to nine metres.

The changes will also increase the maximum size on basement suites from 75 to 100 square metres.

News

Dec. 07, 2015 | Joel Schlesinger

Opportunity knocks in condo sector

In the midst of a correction, experts identify silver-lining investment opportunity

Buy low. Sell high. It's the quintessential mantra of successful investors.

And for those who have long sought to execute this philosophy in Calgary's real estate market, a window of opportunity may be opening thanks to weak oil prices – particularly in the apartment-style condominium sector, which has seen inventory levels skyrocket in 2015.

According to CREB®'s recent monthly housing forecast, months of supply in the apartment sector increased to 6.9 per cent in November, causing benchmark prices to slide

0.5 per cent from October to $287,000. Meanwhile, year-over-year prices were off by 4.6 per cent.

By comparison, months of supply in the detached and attached sector sat at 3.4 and 4.8, respectively.

Buy low. Sell high. It's the quintessential mantra of successful investors.

And for those who have long sought to execute this philosophy in Calgary's real estate market, a window of opportunity may be opening thanks to weak oil prices – particularly in the apartment-style condominium sector, which has seen inventory levels skyrocket in 2015.

According to CREB®'s recent monthly housing forecast, months of supply in the apartment sector increased to 6.9 per cent in November, causing benchmark prices to slide

0.5 per cent from October to $287,000. Meanwhile, year-over-year prices were off by 4.6 per cent.

By comparison, months of supply in the detached and attached sector sat at 3.4 and 4.8, respectively.

News

May 20, 2015 | CREBNow

Keeping it interesting

Interest rates, economic uncertainty impacting Calgary market

For Calgarians Matt and Vanessa Haug, the stars aligned when they decided to purchase a new home in southeast Calgary.

The couple cited low interest rates and competitive house prices behind their decision to act now rather than wait – a sentiment slowly emerging since energy-sector uncertainty took hold in Calgary's housing market late last year.

"We got 2.69 [per cent] on a five-year fixed rate. It definitely impacted our decision," said Matt, who also cited house prices behind their decision to buy and noted the lower rate did not impact how much they ultimately spent on their new home.

For Calgarians Matt and Vanessa Haug, the stars aligned when they decided to purchase a new home in southeast Calgary.

The couple cited low interest rates and competitive house prices behind their decision to act now rather than wait – a sentiment slowly emerging since energy-sector uncertainty took hold in Calgary's housing market late last year.

"We got 2.69 [per cent] on a five-year fixed rate. It definitely impacted our decision," said Matt, who also cited house prices behind their decision to buy and noted the lower rate did not impact how much they ultimately spent on their new home.

News

April 02, 2015 | CREBNow

Inventory gains influence housing prices

First quarter activity reflects economic uncertainty

Elevated inventory levels and low sales for three consecutive months caused unadjusted benchmark prices to ease by 0.44 per cent in March, relative to the previous month, for a total of $454,300. Based on first quarter statistics, conditions are consistent with buyers' market conditions.

Typical home prices have declined by 0.59 per cent in the first quarter of 2015, compared to the fourth quarter of 2014. The sales to new listings ratio also dropped to 41 per cent and months of supply averaged 4.03 for the quarter. This is a significant change from one year ago when the market was facing inventory shortages and price gains.

Elevated inventory levels and low sales for three consecutive months caused unadjusted benchmark prices to ease by 0.44 per cent in March, relative to the previous month, for a total of $454,300. Based on first quarter statistics, conditions are consistent with buyers' market conditions.

Typical home prices have declined by 0.59 per cent in the first quarter of 2015, compared to the fourth quarter of 2014. The sales to new listings ratio also dropped to 41 per cent and months of supply averaged 4.03 for the quarter. This is a significant change from one year ago when the market was facing inventory shortages and price gains.

News

March 19, 2015 | CREBNow

REALTORS give back through Governors' Grants

CREB Charitable Foundation accepting funding applications from local charities

The deadline for charities to apply for this year's Governors' Grants in March 31.

The CREB Charitable Foundation's Governors' Grants program awards funds to charities that support housing and shelter-related initiatives in the Calgary and area community.

The deadline for charities to apply for this year's Governors' Grants in March 31.

The CREB Charitable Foundation's Governors' Grants program awards funds to charities that support housing and shelter-related initiatives in the Calgary and area community.

News

March 13, 2015 | CREBNow

In Quotes: Attainable Homes Varsity

Ground was broken today on a new 26-unit Attainable Homes development.

Working with Lexington Development Management and Nyhoff Architecture, the building, on the corner of Shaganappi Trail and Varsity Drive will provide a combination of attainable homes and market-priced units.

Attainable Homes Calgary Corp. (AHCC) is a non-profit, social enterprise - wholly owned by the City of Calgary - delivering entry-level homes for Calgarians caught in the city's affordability gap.

Here's some of what was said at the groundbreaking:

Working with Lexington Development Management and Nyhoff Architecture, the building, on the corner of Shaganappi Trail and Varsity Drive will provide a combination of attainable homes and market-priced units.

Attainable Homes Calgary Corp. (AHCC) is a non-profit, social enterprise - wholly owned by the City of Calgary - delivering entry-level homes for Calgarians caught in the city's affordability gap.

Here's some of what was said at the groundbreaking: