Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - Investment Properties

Dec. 04, 2019 | Josh Skapin

South Health Campus draws investor interest to Seton

Calgary's newest hospital, the South Health Campus in the southeast community of Seton, is spurring significant interest from investors.

Nov. 13, 2019 | Mario Toneguzzi

REIN reports suggest location should be top of mind for Calgary investment-property buyers

One consideration is whether it's a good time to buy, and the good news is that the market appears to be ripe for investment.

Jan. 16, 2019 | Tyler Difley

How to turn your home into a short-term rental property

As the number of properties listed through short-term rental services like Airbnb and VRBO continues to grow, it's natural for homeowners to wonder if they, too, can extract additional value from their home. Have an extra bedroom, guesthouse or vacation property that sits vacant most of the time? Want to rent out your condo a few weekends a year to make a bit of extra cash? No matter your specific circumstances, here are some important dos and don'ts.

Sept. 07, 2016 | CREBNow

The many faces of rec

Canada's recreational property market continues to transform itself, most recently the beneficiary of record-low interest rates, a new wave of retiring baby boomers and a favourable exchange rate, according to a recent survey.

The 2016 RE/MAX Recreational Property Report, which surveyed RE/MAX agents and brokers, noted the low Canadian dollar is having a positive effect on the country's recreational property markets. Canadians, mainly boomers, who bought properties in the U.S. when U.S. real estate prices were comparably low are selling them at a profit and investing in Canadian recreational markets, it said.

The RE/MAX survey signaled out Canmore and Sylvan Lake as two of Canada's top recreational property destinations. It noted retirees seeking an active lifestyle continue to be an important driver of demand in Canmore, where the median price (May 2015 to April 2016) was $533,090.

July 18, 2016 | Joel Schlesinger

Ready to take flight

Foreign investment in the city's real estate market is poised to take flight.

And it's in no small part thanks to the ambitious expansion of the Calgary International Airport. From the recent opening of its new runway—the longest commercial airstrip in Canada—to its $1.4-billion new international terminal opening this fall, Calgary's bigger, better international airport dramatically increases the number of travellers from overseas.

While it's undoubtedly a shot in the arm to the city's struggling economy, it's not a leap in logic to assume more foreign business and pleasure travellers could provide a boost to its real estate sector, says Eric Horvath, vice president of investment sales at Colliers International.

June 24, 2016 | Cody Stuart

New housing construction down in Alberta

Spending on new residential construction in Alberta totalled $738.3 million in April, down from the $1.025 billion seen the previous April, according to the latest numbers from Statistics Canada.

The 28 per cent decline was the largest fall of any of the provinces, with decreased investment occurring in all dwelling types – although the decline was mainly due to lower spending on single-family dwellings.

In total, spending on new housing construction decreased in five provinces in April. Alberta was followed by Saskatchewan and Manitoba.

May 18, 2016 | CREBNow

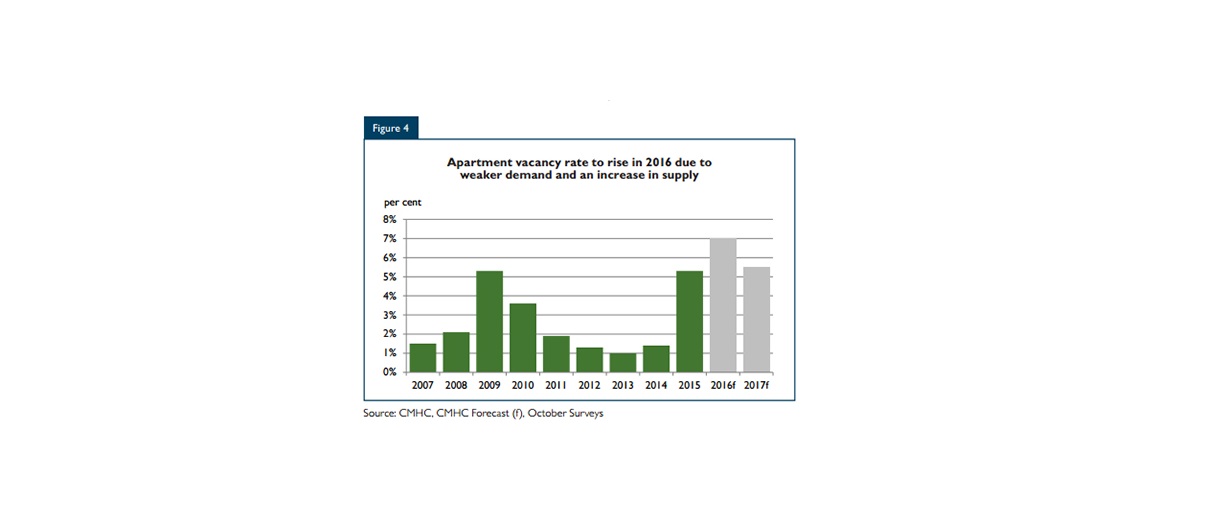

Calgary vacancy rates to rise, rents to decrease: report

Rental vacancy rates in Calgary will rise to seven per cent by this fall, up from 5.3 per cent during the same time last year, according to Canada Mortgage and Housing Corp. (CMHC).

In its semi-annual housing market outlook released today, CMHC said two-bedroom rents are forecast to average $1,270 in October 2016, compared to $1,332 in October 2015.

"A rise in the purpose-built rental vacancy rate along will additional options in the secondary rental market will put downward pressure on rents this year," said the report. "Although incentives will continue to be offered, some landlords will also lower rents to attract tenants."

By the fall of 2017, CMHC expects the vacancy rate in the city to decline back to 5.5 per cent. The two-bedroom rent, meanwhile, is forecast to average $1,260.

Dec. 07, 2015 | Cody Stuart

'Suite' opportunities in detached sector?

Recent changes to secondary suite regulations could spell good news for investors looking for opportunities in Calgary's detached housing sector.

In late November, city council voted to relax the regulations on lot size and increase the amount of floor space allowed in the suites.

Under the new rules, homes zoned R-C1Ls, R-C1s and R-1s will have the minimum lot width removed altogether, while homes zoned R-C1N, R-C2, R-1N and R-2 l will see the minimum lot width reduced to nine metres.

The changes will also increase the maximum size on basement suites from 75 to 100 square metres.

Dec. 07, 2015 | Joel Schlesinger

Opportunity knocks in condo sector

Buy low. Sell high. It's the quintessential mantra of successful investors.

And for those who have long sought to execute this philosophy in Calgary's real estate market, a window of opportunity may be opening thanks to weak oil prices – particularly in the apartment-style condominium sector, which has seen inventory levels skyrocket in 2015.

According to CREB®'s recent monthly housing forecast, months of supply in the apartment sector increased to 6.9 per cent in November, causing benchmark prices to slide

0.5 per cent from October to $287,000. Meanwhile, year-over-year prices were off by 4.6 per cent.

By comparison, months of supply in the detached and attached sector sat at 3.4 and 4.8, respectively.

Dec. 07, 2015 | Barb Livingstone

Planning for tomorrow

Within the next six months, 26-year-old Calgarian Chad Kanovsky intends to take the plunge and buy as many as four multi-family units as income-producing investment properties.

The commercial real estate associate already has a stock portfolio, and is looking to diversify by adding local real estate.

Yet Kanovsky, who started working in land development as a teenager for his father's company, is adamant he will not be jumping into any "get-rich-quick" investment.

"I'm not looking to make a million dollars in the next year and then go to Mexico," he said.