Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - Vacancy Rate

News

Dec. 16, 2020 | Barb Livingstone

With little relief on the horizon, Calgary's downtown office market is expected to struggle well into 2021

Calgary's downtown office vacancy rate is going nowhere but up.

By the end of this year, that rate is projected to jump to 29.5 per cent, and it will climb even higher moving into 2021, says Greg Kwong, regional managing director with commercial real estate company CBRE.

By the end of this year, that rate is projected to jump to 29.5 per cent, and it will climb even higher moving into 2021, says Greg Kwong, regional managing director with commercial real estate company CBRE.

News

April 25, 2018 | Mario Toneguzzi

Down but not out

Downtown office market begins bounce back

People who have lived and worked in Calgary for a long time know that the downtown office market is a great barometer of what's happening in the city's overall economy.

For the past couple of years, record vacancy rates in the heart of the city have made headline news, not only in Calgary, but nationally.

However, a recent report by commercial real estate firm Avison Young suggests we've hit the bottom and there's nowhere to go but up.

News

Aug. 16, 2017 | Kathleen Renne

Targeting tenants

Challenges continue for Calgary's rental market

"Very cautious optimism" is how Gerry Baxter, executive director of the Calgary Residential Rental Association, describes the industry's view of Calgary's current rental landscape.

While Canada Mortgage and Housing Corp. (CMHC) pegged Calgary's rental vacancy rate at seven per cent last fall – the highest it's been in more than 25 years – Baxter says he thinks residential vacancies in the city are actually closer to the eight-to-10-per-cent range.

"There's been some slight improvement in the rental market over the last few weeks, but it's still a challenge to rent," said Baxter, attributing the slack rental market to the economic downturn that started in late 2014 and early 2015.

"Very cautious optimism" is how Gerry Baxter, executive director of the Calgary Residential Rental Association, describes the industry's view of Calgary's current rental landscape.

While Canada Mortgage and Housing Corp. (CMHC) pegged Calgary's rental vacancy rate at seven per cent last fall – the highest it's been in more than 25 years – Baxter says he thinks residential vacancies in the city are actually closer to the eight-to-10-per-cent range.

"There's been some slight improvement in the rental market over the last few weeks, but it's still a challenge to rent," said Baxter, attributing the slack rental market to the economic downturn that started in late 2014 and early 2015.

News

Jan. 19, 2017 | CREBNow

Poised for growth

Calgary's industrial market shows signs of turning the corner

While Calgary's downtown office sector and its plunging vacancy rates overshadowed all commercial real estate activity in 2016, the city's industrial market has better weathered the storm and is poised to grow in 2017, say experts.

According to Barclay Street Real Estate, vacancy for the industrial real estate sector finished 2016 at 7.76 per cent. It had peaked at 7.8 per cent in the third quarter of the year. In 2015, it was 6.57 per cent.

"Absorption was a negative 127,373 square feet for Q3. This was the only quarter of negative absorption we have had since the '90s," said Jon Mook, executive vice-president of Barclay Street Real Estate's industrial division.

While Calgary's downtown office sector and its plunging vacancy rates overshadowed all commercial real estate activity in 2016, the city's industrial market has better weathered the storm and is poised to grow in 2017, say experts.

According to Barclay Street Real Estate, vacancy for the industrial real estate sector finished 2016 at 7.76 per cent. It had peaked at 7.8 per cent in the third quarter of the year. In 2015, it was 6.57 per cent.

"Absorption was a negative 127,373 square feet for Q3. This was the only quarter of negative absorption we have had since the '90s," said Jon Mook, executive vice-president of Barclay Street Real Estate's industrial division.

News

May 18, 2016 | CREBNow

Calgary vacancy rates to rise, rents to decrease: report

CMHC expects renters to benefit from soft economic conditions

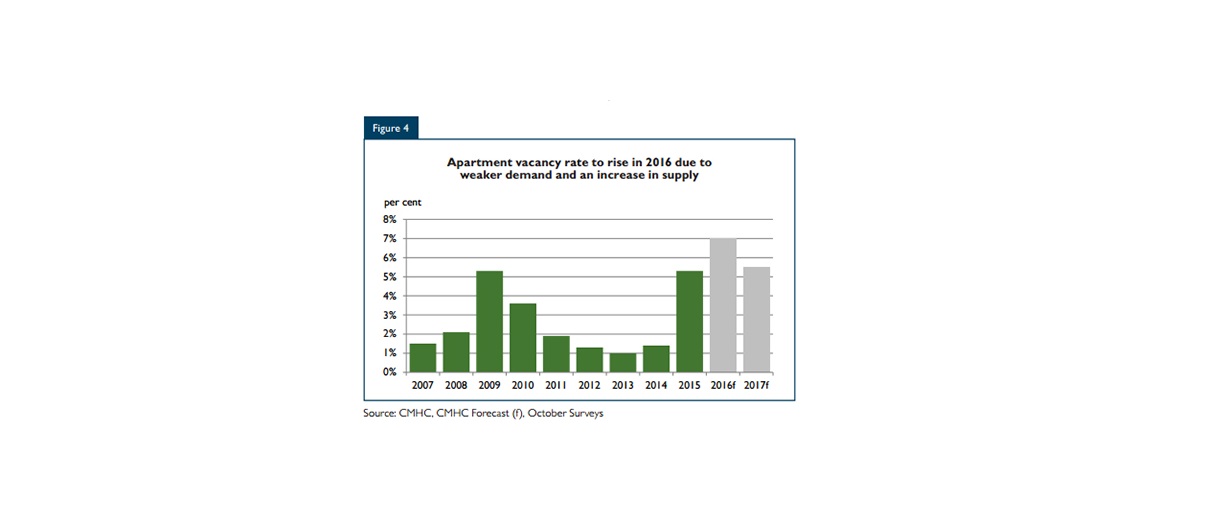

Rental vacancy rates in Calgary will rise to seven per cent by this fall, up from 5.3 per cent during the same time last year, according to Canada Mortgage and Housing Corp. (CMHC).

In its semi-annual housing market outlook released today, CMHC said two-bedroom rents are forecast to average $1,270 in October 2016, compared to $1,332 in October 2015.

"A rise in the purpose-built rental vacancy rate along will additional options in the secondary rental market will put downward pressure on rents this year," said the report. "Although incentives will continue to be offered, some landlords will also lower rents to attract tenants."

By the fall of 2017, CMHC expects the vacancy rate in the city to decline back to 5.5 per cent. The two-bedroom rent, meanwhile, is forecast to average $1,260.

Rental vacancy rates in Calgary will rise to seven per cent by this fall, up from 5.3 per cent during the same time last year, according to Canada Mortgage and Housing Corp. (CMHC).

In its semi-annual housing market outlook released today, CMHC said two-bedroom rents are forecast to average $1,270 in October 2016, compared to $1,332 in October 2015.

"A rise in the purpose-built rental vacancy rate along will additional options in the secondary rental market will put downward pressure on rents this year," said the report. "Although incentives will continue to be offered, some landlords will also lower rents to attract tenants."

By the fall of 2017, CMHC expects the vacancy rate in the city to decline back to 5.5 per cent. The two-bedroom rent, meanwhile, is forecast to average $1,260.

News

Dec. 23, 2015 | Joel Schlesinger

Rental rollercoaster

White-knuckle ride likely isn't over yet

Only a short while ago it was hard to find a place to rent in Calgary. How things have changed.

Calgary's rental market has been a rollercoaster ride since oil prices began to fall in late 2014. The vacancy rate for purpose-built rentals was 5.3 per cent this past October, based on numbers released by Canada Mortgage and Housing Corp. (CMHC) in mid-December. That's almost a 400 per cent increase from October the previous year, when the vacancy rate was 1.4 per cent.

"Obviously, a big part of that is due to a change in the economy," said Richard Cho, principal market analyst for Calgary with CMHC.

Only a short while ago it was hard to find a place to rent in Calgary. How things have changed.

Calgary's rental market has been a rollercoaster ride since oil prices began to fall in late 2014. The vacancy rate for purpose-built rentals was 5.3 per cent this past October, based on numbers released by Canada Mortgage and Housing Corp. (CMHC) in mid-December. That's almost a 400 per cent increase from October the previous year, when the vacancy rate was 1.4 per cent.

"Obviously, a big part of that is due to a change in the economy," said Richard Cho, principal market analyst for Calgary with CMHC.

News

Dec. 15, 2015 | Andrea Cox

Rental market feeling the pain

High rents, job losses contributing to lease breaks, defaults

As the torrential storm of job losses in the province escalates, Calgary's rental community is beginning to feel the fallout.

Rental management groups in the city are reporting a higher incidence of lease breaks and defaults on rent this year as energy sector woes reverberate throughout the economy.

"We've certainly had to do a lot more of this recently than in years' past," said Brett Turner, owner of Redline Real Estate Group Inc., which manages a multitude of rental properties from single-family homes to small apartment buildings.

"We've seen significantly more lease breaks and defaults on rents than ever before."

As the torrential storm of job losses in the province escalates, Calgary's rental community is beginning to feel the fallout.

Rental management groups in the city are reporting a higher incidence of lease breaks and defaults on rent this year as energy sector woes reverberate throughout the economy.

"We've certainly had to do a lot more of this recently than in years' past," said Brett Turner, owner of Redline Real Estate Group Inc., which manages a multitude of rental properties from single-family homes to small apartment buildings.

"We've seen significantly more lease breaks and defaults on rents than ever before."

News

Dec. 07, 2015 | Barb Livingstone

Planning for tomorrow

Investors see opportunities within local housing market

Within the next six months, 26-year-old Calgarian Chad Kanovsky intends to take the plunge and buy as many as four multi-family units as income-producing investment properties.

The commercial real estate associate already has a stock portfolio, and is looking to diversify by adding local real estate.

Yet Kanovsky, who started working in land development as a teenager for his father's company, is adamant he will not be jumping into any "get-rich-quick" investment.

"I'm not looking to make a million dollars in the next year and then go to Mexico," he said.

Within the next six months, 26-year-old Calgarian Chad Kanovsky intends to take the plunge and buy as many as four multi-family units as income-producing investment properties.

The commercial real estate associate already has a stock portfolio, and is looking to diversify by adding local real estate.

Yet Kanovsky, who started working in land development as a teenager for his father's company, is adamant he will not be jumping into any "get-rich-quick" investment.

"I'm not looking to make a million dollars in the next year and then go to Mexico," he said.

News

Oct. 05, 2015 | Joel Schlesinger

The swinging pendulum

Will an increase in vacancy rates push down housing demand?

Calgary has long had a reputation as a difficult place to rent – a reputation confirmed for much of last year when the city's vacancy rate hovered below one per cent.

Yet market uncertainty brought upon by oil patch woes have painted a much different picture in 2015, with Canada Mortgage and Housing Corp. (CMHC) reporting vacancy rates in the city as high as 3.2 per cent.

While good news for renters, it poses as potential bad news for home sellers, notes ATB Financial chief economist Todd Hirsch.

Calgary has long had a reputation as a difficult place to rent – a reputation confirmed for much of last year when the city's vacancy rate hovered below one per cent.

Yet market uncertainty brought upon by oil patch woes have painted a much different picture in 2015, with Canada Mortgage and Housing Corp. (CMHC) reporting vacancy rates in the city as high as 3.2 per cent.

While good news for renters, it poses as potential bad news for home sellers, notes ATB Financial chief economist Todd Hirsch.

News

Aug. 14, 2013 | Cody Stuart

Lowest in Canada

Space in Calgary's once constricted downtown office market could soon be a little easier to come by.

While ranked as the tightest market in Canada in a report from Avison Young, the vacancy rate in the downtown core could escalate alongside new developments set to enter the market.

While ranked as the tightest market in Canada in a report from Avison Young, the vacancy rate in the downtown core could escalate alongside new developments set to enter the market.