Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - budget

Aug. 04, 2022 | Sarah Gillman

Backyard on a budget

Calgary summers always seem to fly by and, with the limited time we get in the sweet sunshine, it’s important to make every moment count outside. Your backyard or patio can serve as your living room for the summer season, and making a few small changes can make it seem like a brand-new outdoor oasis.

Dec. 06, 2021 | Tyler Difley

City council approves property tax hike as part of 2022 budget adjustments

Calgarians will be hit with a property tax increase of nearly four per cent next year, after city council approved the final adjustments to its 2022 budget.

Jan. 10, 2020 | Gerald Vander Pyl

The bottom line: How Calgary's 2020 budget will impact the average homeowner

Sept. 11, 2019 | Tyler Difley

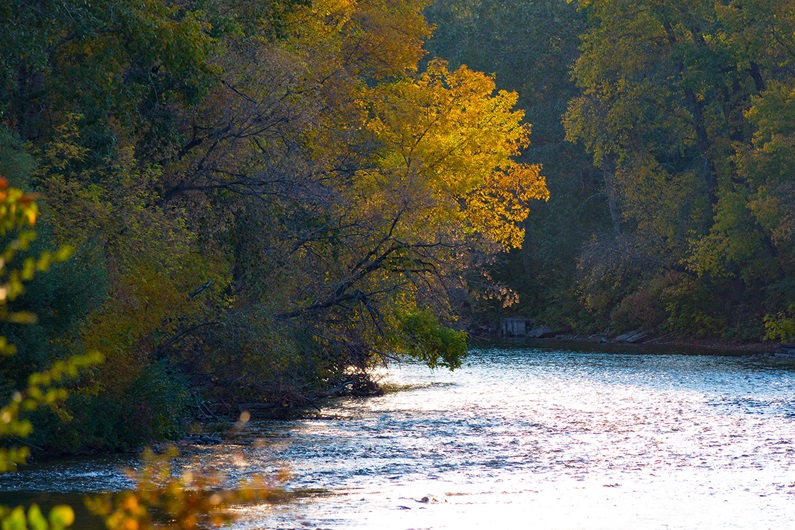

Sixteen affordable Calgary communities for river living

While waterfront real estate will always come at a premium, it's possible to enjoy life near the river in several Calgary communities at a much more reasonable price. Here's a selection of Calgary riverside communities with a year-to-date (YTD) benchmark price lower than the YTD citywide benchmark price of $423,300.

April 10, 2019 | Jim Zang

Federal budget addresses housing affordability with first-time buyer incentive

May 02, 2018 | Geoff Geddes

$300,000 and under

A dollar may not go as far as it used to, but $300,000 can still take Calgary homebuyers a long way.

"At that price, you could look at a one- or two-bedroom apartment with underground or outside parking, and an elevator if you want a high-rise," said Monique Windrem, a REALTOR® and leasing agent with Hope Street Real Estate Corp. "You might get extra storage, and if you opted for a one-bedroom, you may also have a gym, concierge and security if you're not set on living downtown."

May 02, 2018 | Gerald Vander Pyl

Crunching the numbers

Shopping for the home of your dreams requires knowing how much you can afford to spend, which for most buyers ties directly into a mortgage.

Financial institutions in Canada look at a buyer's Gross Debt Service (GDS) and Total Debt Service (TDS) ratios to help determine how much mortgage to approve, and therefore, how much home a person can afford.

June 30, 2016 | CREBNow

Figuring out the financials

So you're ready to be a homeowner. But is your bank account?

Canada Mortgage and Housing Corp. (CMHC) offers the following tips to help first-time homebuyers determine if their financially ready to take that first step:

Dec. 12, 2015 | Cody Stuart

5 things about Canada's middle-class tax cut

$3.4 billion

With around nine million Canadians making between $45,282 and $90,563 set to see their tax bills decrease in 2016, the total cost to the Canadian government will be $3.4 billion. Single individuals who benefit will see an average tax reduction of $330 every year, and couples who benefit will see an average tax reduction of

$540 every year. The maximum tax reduction will be $679 per individual and $1,358 per couple.

Oct. 04, 2015 | Cody Stuart

5 things about Calgary's resilience budget

CREB®Now takes a look at some of those changes:

1. $4.90

With a property tax hike originally pegged at 4.7 per cent when the City released its 2015-2018 Action Plan, the subsequent cut to 3.5 per cent will mean the average Calgarian will be shelling out $4.90 more per month rather than $6.75.