Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - Canada Mortgage & Housing Corporation

News

June 24, 2016 | Paula Trotter

The ABCs of your first mortgage

BMO specialist Laura Parsons highlights often-overlooked programs for first-time buyers

Price is the deciding factor for many young adults who are purchasing their first home.

This isn't necessarily a bad thing; but you actually risk taking a financial hit when you fixate solely on what you think you can afford, said BMO mortgage specialist Laura Parsons.

"Millennials tend to migrate to affordability instead of understanding their options," said Parsons, who has more than 30 years of mortgage experience.

Price is the deciding factor for many young adults who are purchasing their first home.

This isn't necessarily a bad thing; but you actually risk taking a financial hit when you fixate solely on what you think you can afford, said BMO mortgage specialist Laura Parsons.

"Millennials tend to migrate to affordability instead of understanding their options," said Parsons, who has more than 30 years of mortgage experience.

News

June 24, 2016 | Marty Hope

Taking the plunge

Calgary couple's research, timing pays off during first home purchase

Booker and Lisa Zaytsoff didn't take the plunge into homeownership lightly.

About a year ago, the young couple started to investigate the marketplace, getting a read on what was happening – all the while putting away money for a down payment.

"Finally, we had enough saved up so decided to buy — something that, for us, had always been in the cards," said Booker. "What was important for us was location and price. The fact mortgage rates were low was a bonus."

Booker and Lisa Zaytsoff didn't take the plunge into homeownership lightly.

About a year ago, the young couple started to investigate the marketplace, getting a read on what was happening – all the while putting away money for a down payment.

"Finally, we had enough saved up so decided to buy — something that, for us, had always been in the cards," said Booker. "What was important for us was location and price. The fact mortgage rates were low was a bonus."

News

June 23, 2016 | Alex Frazer Harrison

Over-under

Housing officials cite increasing rates of overcrowding in Calgary's housing market

Housing experts say a soft labour pool brought upon by weak economic conditions is partly to blame for increasing rates of overcrowding, or "underhousing" in Calgary homes.

RESOLVE executive director Sheryl Barlage – whose organization is made up of nine partner agencies aimed at building affordable and supported rental homes for 3,000 homeless and vulnerable Calgarians by March 31, 2018 – says about 3,500 Calgarians were considered homeless in a recent Homeless Foundation survey, with about 14,000 at risk of homelessness – and that doesn't include people "couch-surfing."

With the economic downturn, "we know fundamentally that number is up. It's hard to get a handle; people are one paycheque away (from homelessness) or aren't in appropriate housing. And the current economic climate (as well as) social issues are impacting the need. But the need has always been urgent."

Housing experts say a soft labour pool brought upon by weak economic conditions is partly to blame for increasing rates of overcrowding, or "underhousing" in Calgary homes.

RESOLVE executive director Sheryl Barlage – whose organization is made up of nine partner agencies aimed at building affordable and supported rental homes for 3,000 homeless and vulnerable Calgarians by March 31, 2018 – says about 3,500 Calgarians were considered homeless in a recent Homeless Foundation survey, with about 14,000 at risk of homelessness – and that doesn't include people "couch-surfing."

With the economic downturn, "we know fundamentally that number is up. It's hard to get a handle; people are one paycheque away (from homelessness) or aren't in appropriate housing. And the current economic climate (as well as) social issues are impacting the need. But the need has always been urgent."

News

June 06, 2016 | Jamie Zachary

5 things on housing market's health

New report paints mid-term picture

RBC Economics economist Craig Wright and Robert Hogue say the provincial recession continues to weigh on housing demand in Calgary, and such weakness is increasingly undermining prices.

In the bank's Canadian Housing Health Check released this week, the report's authors note the drop in property values has been generally modest to date; however, the pace of decline has accelerated and further downside remains.

Here are five things to know about contributors to Calgary's housing health so far this year:

RBC Economics economist Craig Wright and Robert Hogue say the provincial recession continues to weigh on housing demand in Calgary, and such weakness is increasingly undermining prices.

In the bank's Canadian Housing Health Check released this week, the report's authors note the drop in property values has been generally modest to date; however, the pace of decline has accelerated and further downside remains.

Here are five things to know about contributors to Calgary's housing health so far this year:

News

May 18, 2016 | CREBNow

Weak conditions expected to dampen housing starts

CMHC forecasts slowdown in new home construction

Calgary housing starts are forecast to decline for the second consecutive year in 2016, according to a new report.

In its semi-annual housing market outlook released today, Canada Mortgage and Housing Corp. (CMHC) noted reduced investments and layoffs in the energy industry due to low oil prices have spread and have impacted labour market conditions across many different industries. Elevated unemployment rates will slow down migration and income growth, while employment is expected to decline. As a result, housing demand will continue to deteriorate this year.

This, combined with a rise in inventory, will reduce the pace of new home construction. Total housing starts in 2016 will range between 8,400 and 9,400 units, down from 13,033 units in 2015.

Calgary housing starts are forecast to decline for the second consecutive year in 2016, according to a new report.

In its semi-annual housing market outlook released today, Canada Mortgage and Housing Corp. (CMHC) noted reduced investments and layoffs in the energy industry due to low oil prices have spread and have impacted labour market conditions across many different industries. Elevated unemployment rates will slow down migration and income growth, while employment is expected to decline. As a result, housing demand will continue to deteriorate this year.

This, combined with a rise in inventory, will reduce the pace of new home construction. Total housing starts in 2016 will range between 8,400 and 9,400 units, down from 13,033 units in 2015.

News

May 18, 2016 | CREBNow

Calgary vacancy rates to rise, rents to decrease: report

CMHC expects renters to benefit from soft economic conditions

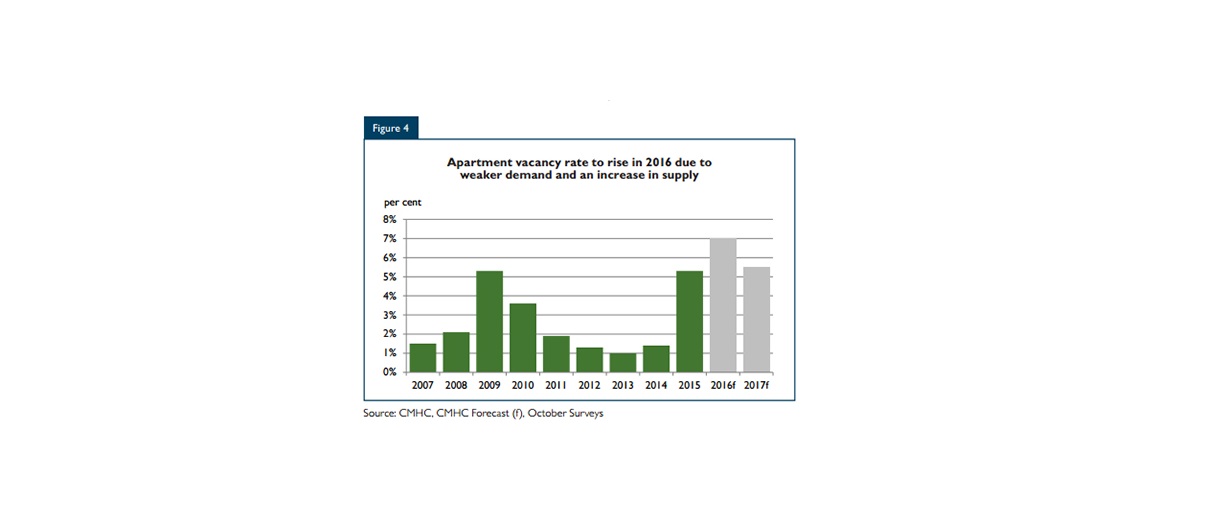

Rental vacancy rates in Calgary will rise to seven per cent by this fall, up from 5.3 per cent during the same time last year, according to Canada Mortgage and Housing Corp. (CMHC).

In its semi-annual housing market outlook released today, CMHC said two-bedroom rents are forecast to average $1,270 in October 2016, compared to $1,332 in October 2015.

"A rise in the purpose-built rental vacancy rate along will additional options in the secondary rental market will put downward pressure on rents this year," said the report. "Although incentives will continue to be offered, some landlords will also lower rents to attract tenants."

By the fall of 2017, CMHC expects the vacancy rate in the city to decline back to 5.5 per cent. The two-bedroom rent, meanwhile, is forecast to average $1,260.

Rental vacancy rates in Calgary will rise to seven per cent by this fall, up from 5.3 per cent during the same time last year, according to Canada Mortgage and Housing Corp. (CMHC).

In its semi-annual housing market outlook released today, CMHC said two-bedroom rents are forecast to average $1,270 in October 2016, compared to $1,332 in October 2015.

"A rise in the purpose-built rental vacancy rate along will additional options in the secondary rental market will put downward pressure on rents this year," said the report. "Although incentives will continue to be offered, some landlords will also lower rents to attract tenants."

By the fall of 2017, CMHC expects the vacancy rate in the city to decline back to 5.5 per cent. The two-bedroom rent, meanwhile, is forecast to average $1,260.

News

May 18, 2016 | CREBNow

Calgary housing prices to decline further: report

CMHC report forecasts buyers' conditions will continue in 2016/17

Calgary housing prices will continue to decline in 2016, according to Canada Mortgage and Housing Corp. (CMHC), which predicts the average MLS® residential price in the city will range between $444,500 and $449,500, compared to $453,814 in 2015.

In its semi-annual housing market outlook, released today, CMHC also said it detected moderate evidence of overvaluation as house prices have not been fully supported by economic and demographic fundamentals.

In 2017, house prices in the resale market are anticipated to gradually stabilize as the market shifts to more balanced levels. Improvements in economic conditions and housing demand combined with less supply will help support home prices, said CMHC.

The MLS® average residential price in 2017 is forecast to range from $450,400 to $455,600.

Calgary housing prices will continue to decline in 2016, according to Canada Mortgage and Housing Corp. (CMHC), which predicts the average MLS® residential price in the city will range between $444,500 and $449,500, compared to $453,814 in 2015.

In its semi-annual housing market outlook, released today, CMHC also said it detected moderate evidence of overvaluation as house prices have not been fully supported by economic and demographic fundamentals.

In 2017, house prices in the resale market are anticipated to gradually stabilize as the market shifts to more balanced levels. Improvements in economic conditions and housing demand combined with less supply will help support home prices, said CMHC.

The MLS® average residential price in 2017 is forecast to range from $450,400 to $455,600.

News

April 11, 2016 | Cody Stuart

Five things about household debt in Canada

CMHC survey paints picture of Canadians' financial health

The financial health of Canadians has received widespread attention in the media with the debt-to-income ratio reaching record levels in recent years. Despite rising indebtedness, low interest rates in recent years have kept the cost of servicing debt manageable.

To help get a handle on where Canadians debt lies, CREB®Now digs into CMHC's debt survey.

$1.9 trillion

Over the past decade, Canadian households have become increasingly indebted, with total household credit edging higher again in the third quarter of 2015 to $1.9 trillion. Mortgage credit, at over 70 per cent of total debt, was the principal driver of this increase. Between 2001 and 2011, average inflation-adjusted MLS® residential housing prices appreciated by 72 per cent.

The financial health of Canadians has received widespread attention in the media with the debt-to-income ratio reaching record levels in recent years. Despite rising indebtedness, low interest rates in recent years have kept the cost of servicing debt manageable.

To help get a handle on where Canadians debt lies, CREB®Now digs into CMHC's debt survey.

$1.9 trillion

Over the past decade, Canadian households have become increasingly indebted, with total household credit edging higher again in the third quarter of 2015 to $1.9 trillion. Mortgage credit, at over 70 per cent of total debt, was the principal driver of this increase. Between 2001 and 2011, average inflation-adjusted MLS® residential housing prices appreciated by 72 per cent.

News

April 01, 2016 | Mario Toneguzzi

Trickle-down effect

New home industry to impact inventory, prices

Homebuyers could be in for more good news over the next several months as industry experts predict oversupply from the new home industry will create more selection and overall price softness.

"With the number of units still under construction, we do expect inventories to continue moving higher in the next couple of months," said Richard Cho, market analyst in Calgary for Canada Mortgage and Housing Corp. (CMHC). "I think the impact that would have on the overall housing market and the resale market is more choice for buyers."

Cho added the number of units still under construction remains elevated, which will lead to the rise in inventory levels.

Homebuyers could be in for more good news over the next several months as industry experts predict oversupply from the new home industry will create more selection and overall price softness.

"With the number of units still under construction, we do expect inventories to continue moving higher in the next couple of months," said Richard Cho, market analyst in Calgary for Canada Mortgage and Housing Corp. (CMHC). "I think the impact that would have on the overall housing market and the resale market is more choice for buyers."

Cho added the number of units still under construction remains elevated, which will lead to the rise in inventory levels.

News

March 11, 2016 | Cody Stuart

5 things about housing needs

CMHC paints sobering picture of in-need housing

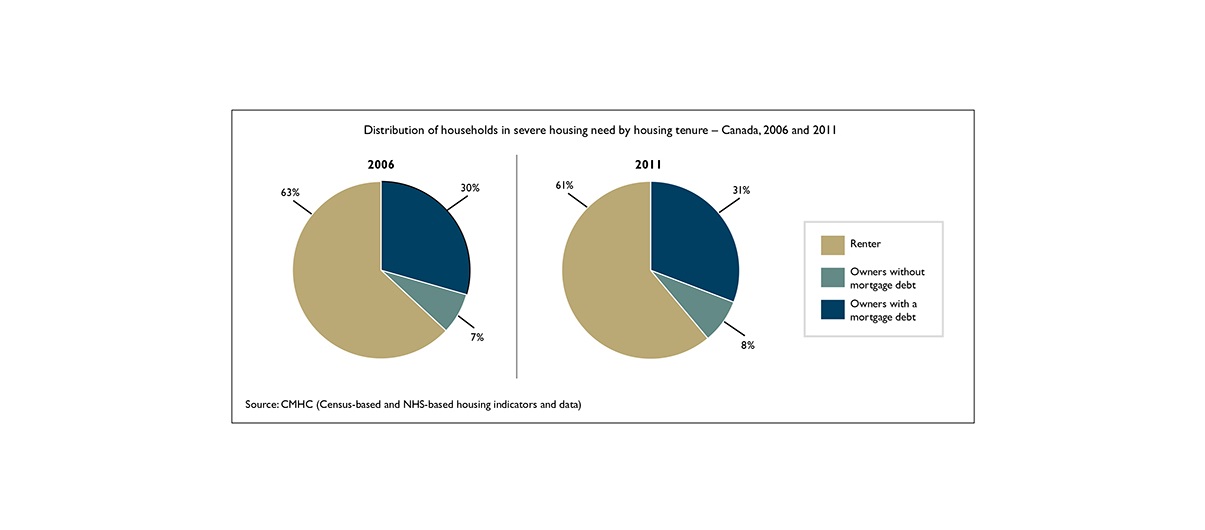

Canada Mortgage and Housing Corp. (CMHC) recently released a report on "core housing need" in Canada that paints a sobering picture for those in need in this country.

CREB®Now takes a closer look at the report, which focuses on households that spend in excess of 50 per cent of their income on shelter.

5.3%

From 2006-11, the incidence of Canadian households in severe housing need increased, reaching 5.3 per cent, or 655,380 households – consistent with 2001 levels. Shelter costs for all Canadian households during this period increased more rapidly than household income before tax, which could partially explain the increase in the number and percentage of households in severe housing need during this period, said CMHC.

Canada Mortgage and Housing Corp. (CMHC) recently released a report on "core housing need" in Canada that paints a sobering picture for those in need in this country.

CREB®Now takes a closer look at the report, which focuses on households that spend in excess of 50 per cent of their income on shelter.

5.3%

From 2006-11, the incidence of Canadian households in severe housing need increased, reaching 5.3 per cent, or 655,380 households – consistent with 2001 levels. Shelter costs for all Canadian households during this period increased more rapidly than household income before tax, which could partially explain the increase in the number and percentage of households in severe housing need during this period, said CMHC.