Nov. 03, 2025 | CREB

Pace of new listings growth slows, preventing further inventory gains

Inventory levels eased over last month thanks to the combined impact of a monthly pullback in new listings and a monthly pick up in sales.

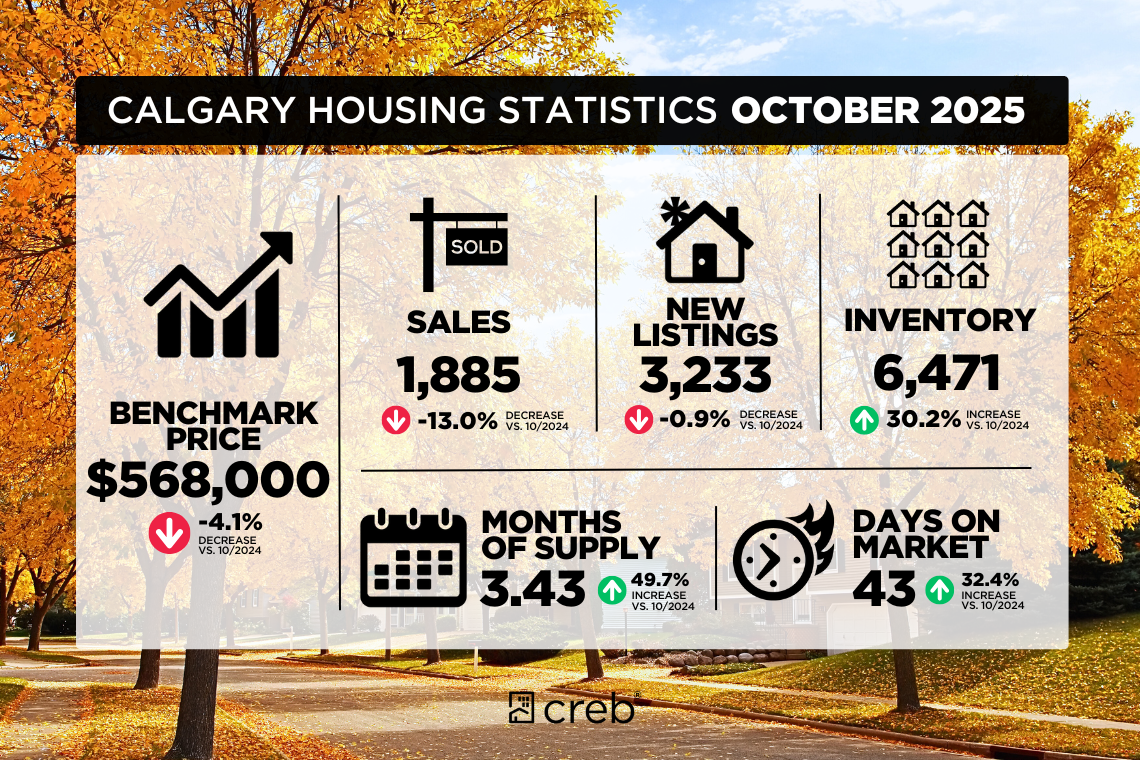

With 6,471 units in inventory and 1,885 sales the October months of supply returned to three-and-a-half months after pushing up to four months in September. While both row- and apartment-style properties continue to report elevated supply levels compared to demand, conditions remain relatively balanced for both detached and semi-detached properties.

Year-to-date sales in the city totaled 20,082, down nearly 16 per cent compared to last year, but still in line with longer-term trends. Much of the decline in sales has been driven by pullbacks for apartment- and row-style homes.

“Improved rental supply and easing rents have slowed ownership demand for apartment- and row-style homes. It is also these segments of the market that have seen October inventories reach a record high for the month,” said Ann-Marie Lurie, CREB®’s Chief Economist. “Excess supply for apartment- and row-style properties is weighing on prices in those segments more so than any other property type, influencing total residential prices.”

As of October, the total unadjusted residential benchmark price in Calgary was $568,000, down nearly one per cent compared to last month and over four per cent lower than last year’s levels. The largest price adjustments occurred for row- and apartment-style properties where prices have eased by a respective six and seven per cent compared to last October.

Detached

October sales reached 1,012 units, an improvement over last month, but still five per cent lower than last year’s levels. At the same time there were 1,593 new listings that came onto the market, causing the sales-to-new-listings ratio to rise to 64 per cent and inventories to trend down over last month to 2,913. Inventory levels remain slightly higher than long-term trends for the month, but with just under three months of supply, conditions remain relatively balanced and far better than conditions reported during the 2015 to 2019 period. Despite relatively balanced conditions, there are pockets of the market that are experiencing buyer’s market conditions, which is impacting prices. Citywide detached benchmark prices eased to $744,400 in October, one per cent lower than last year. However, price adjustments ranged from a year-over-year gain of nearly two per cent in the City Centre to a decline of over five per cent in the North East district. Despite recent adjustments, year-to-date prices remain over one per cent higher than last year.

Semi-Detached

Sales improved over last month while new listings slowed, causing the sales-to-new-listing ratio to rise to 57 per cent, which is slightly lower than typical levels for this time of year, but high enough to prevent any significant change in inventory levels compared to last month. With 186 sales and 613 units in inventory, the months of supply was over three months, higher than last year’s extremely low levels, but lower than last month. More inventory choice has weighed on prices over the past several months. However, with an October benchmark price of $683,100, prices remain nearly one per cent higher than last year and on a year-to-date basis are over three per cent higher than last year.

Row

With 275 sales in October, year-to-date row sales totaled 3,412 units, a 17 per cent decline over last year. While row sales remain well above long-term trends, new listings have been on the rise and reached record highs so far this year. As of October, there were 1,054 units in inventory, the highest ever reported for the month and nearly 32 per cent higher than long-term averages. This also caused the months of supply to remain around four months. The additional supply choice has weighed on prices. The October benchmark price was $431,200, over one per cent lower than last month and nearly six per cent lower than prices reported last year at this time. The steady slide in row prices have caused year-to-date prices to drop by one-and-a-half per cent. Price adjustments did vary across the city with the largest year-to-date declines occurring in the North East and North districts.

Apartment Condominium

The pullback in new listings relative to sales this month did help prevent further gains in inventory levels. However, with 1,891 units in inventory and 412 sales, the months of supply remained elevated at nearly five months. Apartment condominiums have been experiencing buyer’s market conditions for nearly 6 months, placing downward pressure on prices. As of October, the benchmark price was $318,200, down over one per cent compared to last month, and nearly seven per cent lower than last October. On a year-to-date basis, prices are nearly two per cent lower than last year’s levels. The largest year-to-date price declines occurred in the North East and South East districts at four per cent, as those districts are either reporting the highest months of supply on the resale market or are facing significant competition from the new home market.

REGIONAL MARKET FACTS

Airdrie

Activity slowed as we moved into October. While sales have remained consistent with longer-term trends, new listings reached a record high for October, keeping inventories elevated. With 535 units in inventory and 136 sales, the months of supply remained over four months. The persistently higher months of supply over the past four months, combined with additional supply choice in the new home market, has weighed on resale home prices. Prices in Airdrie have been trending down since April of this year and as of October the benchmark price was $520,400, nearly one per cent lower than last month and nearly five per cent lower than last year’s levels.

Cochrane

Sales in Cochrane improved this month, keeping year-to-date sales at levels that are relatively consistent with last year. At the same time, while levels remained high, new listings did trend down over last month, causing the sales-to-new-listings ratio to rise to 55 per cent and preventing any further gains in inventory levels. The months of supply eased to just over four months in October, higher than the low levels reported over the past several years, but relatively more consistent with long-term trends for the month. As of October, the benchmark price was $585,200, similar to last month and over two per cent higher than last year. Year-to-date prices in the area have risen by nearly four per cent. Some of the gain in prices could be related to a larger share of new homes ending up being sold on the resale market in Cochrane.

Okotoks

October reported 91 new listings on the market, a significant gain over last month and last year’s levels. The rise in new listings was met with slower sales activity, causing the sales-to-new-listings ratio to dip below 50 per cent, supporting a modest gain in inventory levels. While inventory levels are finally improving, they remain low relative to longer-term trends. This has likely prevented a more significant shift in prices in the Okotoks area. In October, the unadjusted benchmark price was $618,600, up over last month but consistent with last October. Year-to-date benchmark prices have improved by over one per cent.

Click here to view the full City of Calgary monthly stats package.

Click here to view the full Calgary region monthly stats package.

Tagged: Monthly Housing Summary