Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - listings

News

Feb. 05, 2016 | Jamie Zachary

Five things about housing stats

Understanding the lingo

CREB® released its regional housing market statistics earlier this week for January, showing the residential housing market is continued to be challenged by energy sector uncertainty. But what does it mean for homeowners?

CREB®Now breaks down the lingo in this week's "Five Things" feature.

Sales

CREB® reported that sales of all housing types in Calgary are down 13 per cent from last January to 763 units. By segment, however, a slightly different story begins to unfold. While sales in the detached market decreased by an identical 13 per cent, the attached sector dropped by just over 10 per cent, while the apartment sector fell by a precipitous 16 per cent. For sellers, this shows which segments are more active than others – keeping in mind that the detached sector still represents nearly two-thirds of all sales activity.

CREB® released its regional housing market statistics earlier this week for January, showing the residential housing market is continued to be challenged by energy sector uncertainty. But what does it mean for homeowners?

CREB®Now breaks down the lingo in this week's "Five Things" feature.

Sales

CREB® reported that sales of all housing types in Calgary are down 13 per cent from last January to 763 units. By segment, however, a slightly different story begins to unfold. While sales in the detached market decreased by an identical 13 per cent, the attached sector dropped by just over 10 per cent, while the apartment sector fell by a precipitous 16 per cent. For sellers, this shows which segments are more active than others – keeping in mind that the detached sector still represents nearly two-thirds of all sales activity.

News

Feb. 05, 2016 | Jamie Zachary

Timing the market

Housing stats indicate some buyers still sitting on the sidelines

Calgary's resale residential housing market picked up where it left off in 2015, with buyers' conditions prevailing through every major category last month, according to CREB®.

Yet with many homebuyers still sitting on the fence, local housing officials caution that historically it's been difficult to find a utopian moment to enter the market.

"Buyers, especially first-time buyers and investors, will do their best to time the bottom, but I think that will be really difficult," said CREB® president Cliff Stevenson, noting that few were able to do so during the last recession in 2008/09 when the upturn happened quickly. "I think this year it will be a guessing game as to when will be the best time to get into the market."

Calgary's resale residential housing market picked up where it left off in 2015, with buyers' conditions prevailing through every major category last month, according to CREB®.

Yet with many homebuyers still sitting on the fence, local housing officials caution that historically it's been difficult to find a utopian moment to enter the market.

"Buyers, especially first-time buyers and investors, will do their best to time the bottom, but I think that will be really difficult," said CREB® president Cliff Stevenson, noting that few were able to do so during the last recession in 2008/09 when the upturn happened quickly. "I think this year it will be a guessing game as to when will be the best time to get into the market."

News

Feb. 01, 2016 | CREBNow

Housing market remains unchanged in January

Slow sales activity and inventory gains place downward pressure on prices

Calgary's housing market is starting 2016 firmly in buyers' market territory, much the same as last year ended, according to CREB®'s monthly housing summary for January.

"The recent slide in energy prices has raised concerns about near-term recovery prospects for the city," said CREB® chief economist Ann-Marie Lurie. "Energy market uncertainty and a soft labour market are weighing on many aspects of our economy, including the housing sector."

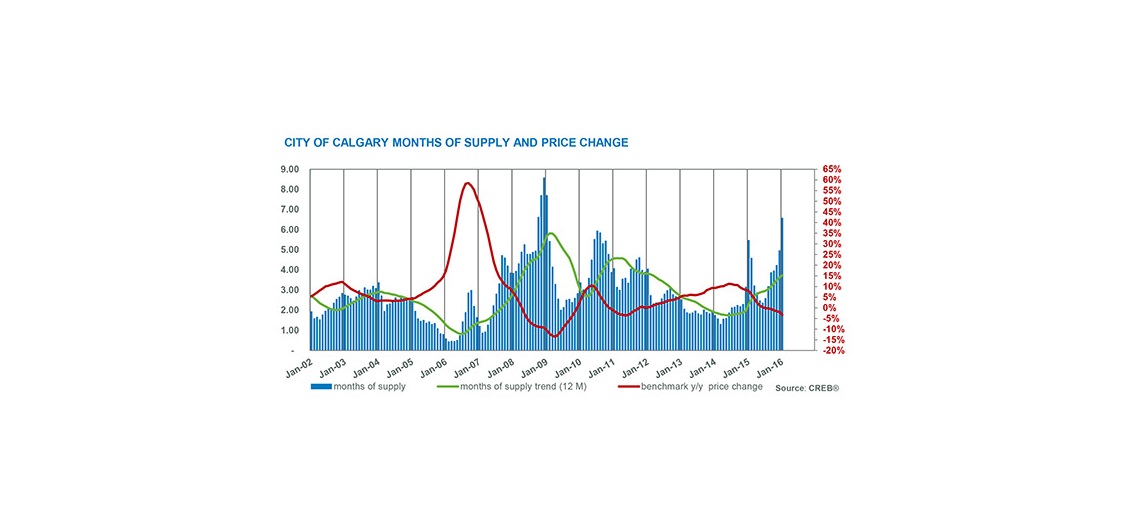

City wide, January sales totaled 763 units, 13 per cent below last year and 43 per cent below long-term averages. While new listings declined by 16 per cent compared to January 2015, the number of new listings far outpaced the sales, causing inventory gains. January's city wide months of supply levels rose above six months.

Calgary's housing market is starting 2016 firmly in buyers' market territory, much the same as last year ended, according to CREB®'s monthly housing summary for January.

"The recent slide in energy prices has raised concerns about near-term recovery prospects for the city," said CREB® chief economist Ann-Marie Lurie. "Energy market uncertainty and a soft labour market are weighing on many aspects of our economy, including the housing sector."

City wide, January sales totaled 763 units, 13 per cent below last year and 43 per cent below long-term averages. While new listings declined by 16 per cent compared to January 2015, the number of new listings far outpaced the sales, causing inventory gains. January's city wide months of supply levels rose above six months.

News

Jan. 12, 2016 | Gerald Vander Pyl

Apartment uncertainty

Beleaguered sector takes brunt of economic downturn

Apartment-style condominiums were the hardest hit within Calgary's resale residential housing market in 2015, with price drops and inventory gains that outpaced both attached and detached products

On an annual basis, the apartment benchmark price slide by 0.4 per cent to $292,818 by the end of November, according to CREB®. In comparison, year-to-date benchmark prices in the detached and attached sectors during the same period actually increased by 1.7 and 2.1 per cent, respectively.

Yet more telling is how apartment prices reacted during the year, as it dropped by four per cent from $298,700 in January to $287,000 in November. During this period, benchmark prices in the detached and attached sectors declined by a more modest 1.5 and one per cent, respectively.

Apartment-style condominiums were the hardest hit within Calgary's resale residential housing market in 2015, with price drops and inventory gains that outpaced both attached and detached products

On an annual basis, the apartment benchmark price slide by 0.4 per cent to $292,818 by the end of November, according to CREB®. In comparison, year-to-date benchmark prices in the detached and attached sectors during the same period actually increased by 1.7 and 2.1 per cent, respectively.

Yet more telling is how apartment prices reacted during the year, as it dropped by four per cent from $298,700 in January to $287,000 in November. During this period, benchmark prices in the detached and attached sectors declined by a more modest 1.5 and one per cent, respectively.

News

Jan. 04, 2016 | CREBNow

Housing market characterized by slow demand

Elevated supply levels placed downward pressure on prices in December

With the focus shifting toward the holiday season, December sales activity slowed to 878 units in the city, 18 per cent below last year at this time and well below the five- and 10-year averages, according to CREB®'s final monthly housing summary of 2015.

As a result, the unadjusted benchmark price dipped to $448,800, a 0.42 per cent decline over the previous month and 2.33 year over year.

CREB® chief economist Ann-Marie Lurie noted December followed a pattern established early on in 2015, which was characterized by slower housing demand.

With the focus shifting toward the holiday season, December sales activity slowed to 878 units in the city, 18 per cent below last year at this time and well below the five- and 10-year averages, according to CREB®'s final monthly housing summary of 2015.

As a result, the unadjusted benchmark price dipped to $448,800, a 0.42 per cent decline over the previous month and 2.33 year over year.

CREB® chief economist Ann-Marie Lurie noted December followed a pattern established early on in 2015, which was characterized by slower housing demand.

News

Dec. 29, 2015 | Alex Frazer Harrison

Lasting luxury

Experts believe higher-priced home market is not out for the count

Despite ongoing oil patch uncertainty that plagued the province's economy for much of 2014, Calgary's luxury housing market is still alive and well, say industry insiders.

While experts acknowledge the sector is going through a rough patch, they say the industry is undaunted, instead pushing ahead in hopes that Alberta's infamous cyclical economy is due for another upswing.

Despite ongoing oil patch uncertainty that plagued the province's economy for much of 2014, Calgary's luxury housing market is still alive and well, say industry insiders.

While experts acknowledge the sector is going through a rough patch, they say the industry is undaunted, instead pushing ahead in hopes that Alberta's infamous cyclical economy is due for another upswing.

News

Dec. 23, 2015 | CREBNow

A look back at 2015 with CREB®'s chief economist

The year according to CREB®'s Ann-Marie Lurie

With the calendar set to turn on what's been a turbulent year in the city's real estate industry, many will wondering what to expect in 2016 and beyond. To help provide a little clarity on just how we got here, as well as a hint as to where we're headed, CREB®Now enlisted CREB® chief economist Ann-Marie Lurie to provide some end-of-year insight.

CREB®Now: ?How would you sum up 2015 in Calgary real estate?

Lurie: It has been a year of weaker demand – definitely challenging economic times resulting in weaker demand. As a result there has been some more inventory than we are used to in the market and there has been some downward regression on pricing. It's completely consistent with what the economic situation has been.

With the calendar set to turn on what's been a turbulent year in the city's real estate industry, many will wondering what to expect in 2016 and beyond. To help provide a little clarity on just how we got here, as well as a hint as to where we're headed, CREB®Now enlisted CREB® chief economist Ann-Marie Lurie to provide some end-of-year insight.

CREB®Now: ?How would you sum up 2015 in Calgary real estate?

Lurie: It has been a year of weaker demand – definitely challenging economic times resulting in weaker demand. As a result there has been some more inventory than we are used to in the market and there has been some downward regression on pricing. It's completely consistent with what the economic situation has been.

News

Dec. 23, 2015 | Cody Stuart

2015: Year in review

A look back at Calgary's resale residential housing market

If nothing else, 2015 was an interesting year for Calgary's housing market.

While it remained resilient even while oil prices began to slide, the conditions that arose as 2014 drew to a close signaled a change was in the air.

And so as Christmas came and went, December 2014 saw the first year-year-year sales decline following 11 consecutive months of year-over-year growth. And with little expectation that things would change, once-lofty expectations gave way to a more realistic outlook.

If nothing else, 2015 was an interesting year for Calgary's housing market.

While it remained resilient even while oil prices began to slide, the conditions that arose as 2014 drew to a close signaled a change was in the air.

And so as Christmas came and went, December 2014 saw the first year-year-year sales decline following 11 consecutive months of year-over-year growth. And with little expectation that things would change, once-lofty expectations gave way to a more realistic outlook.

News

Oct. 23, 2015 | Jamie Zachary

Regional housing prices decline for first time in '15

Higher inventory levels consistent throughout surrounding area

Alberta's economic downturn caught up with the residential housing industry outside of Calgary in the third quarter as price declined for the first time in 2015, says a new report from CREB®.

Despite the slight scale back, prices remained relatively resilient when compared to double-digit declines in sales that sparked a rise in inventory levels.

In its latest surrounding area quarterly summary, CREB® reported benchmark prices from July to September fell by 0.41 per cent from the previous quarter to $433,033. That compares to gains realized in the two previous quarters.

Alberta's economic downturn caught up with the residential housing industry outside of Calgary in the third quarter as price declined for the first time in 2015, says a new report from CREB®.

Despite the slight scale back, prices remained relatively resilient when compared to double-digit declines in sales that sparked a rise in inventory levels.

In its latest surrounding area quarterly summary, CREB® reported benchmark prices from July to September fell by 0.41 per cent from the previous quarter to $433,033. That compares to gains realized in the two previous quarters.

News

July 02, 2015 | CREBNow

June sales consistent with typical levels

Calgary inventory levels ease

Despite the 18 per cent year-over-year decline in June home sales, for a total of 2,183 units, transaction levels remain only five per cent below the 10 year average for June and three per cent above levels over the past five years.

"We've seen less concern from consumers lately," said CREB® president Corinne Lyall. "One of the main reasons is that we haven't seen the worst case scenarios play out in the energy and housing sectors.

"Consumers who were waiting for wide-spread price declines have been surprised to see that it just hasn't happened yet, and so they've decided to take advantage of the improved selection and lower lending rates.

Despite the 18 per cent year-over-year decline in June home sales, for a total of 2,183 units, transaction levels remain only five per cent below the 10 year average for June and three per cent above levels over the past five years.

"We've seen less concern from consumers lately," said CREB® president Corinne Lyall. "One of the main reasons is that we haven't seen the worst case scenarios play out in the energy and housing sectors.

"Consumers who were waiting for wide-spread price declines have been surprised to see that it just hasn't happened yet, and so they've decided to take advantage of the improved selection and lower lending rates.