Calgary's trusted source of real estate news, advice and statistics since 1983.

Stories Tagged - Housing Prices

News

Dec. 02, 2016 | Barb Livingstone

Future of housing

Stakeholders say Alberta can't be overlooked when creating national strategy

As the federal government moves closer toward a national strategy on housing, key Alberta stakeholder groups say recognition of different local and regional challenges is critical to any policy changes.

"We are encouraged the federal government is doing this, but we are hoping its actions will be localized," said Kevin McNichol, vice-president of strategy for the Calgary Homeless Foundation, leader of the city's plan to end homelessness.

"In Calgary, we have the highest median income in the country, so it might be easy to overlook us. But we also have the lowest rate of affordable housing in Canada."

As the federal government moves closer toward a national strategy on housing, key Alberta stakeholder groups say recognition of different local and regional challenges is critical to any policy changes.

"We are encouraged the federal government is doing this, but we are hoping its actions will be localized," said Kevin McNichol, vice-president of strategy for the Calgary Homeless Foundation, leader of the city's plan to end homelessness.

"In Calgary, we have the highest median income in the country, so it might be easy to overlook us. But we also have the lowest rate of affordable housing in Canada."

News

Aug. 08, 2016 | Cailynn Klingbeil

55 years of real estate: 1990 CREB® president John Fraser

Former CREB® president John Fraser recalled new sense of hope in 1990 after decade of challenges

A fresh start: that's how many viewed 1990, recalled then-CREB® president John Fraser.

"We had just come out of an extremely difficult period," he said, referencing a decade defined by the National Energy Program, soaring interest rates and growing unemployment in the province.

"In about the mid '80s, things started to improve. And by about 1990, if you can believe it, almost 10 years later, we were almost back to where we were in 1981 in terms of house prices."

A fresh start: that's how many viewed 1990, recalled then-CREB® president John Fraser.

"We had just come out of an extremely difficult period," he said, referencing a decade defined by the National Energy Program, soaring interest rates and growing unemployment in the province.

"In about the mid '80s, things started to improve. And by about 1990, if you can believe it, almost 10 years later, we were almost back to where we were in 1981 in terms of house prices."

News

June 30, 2016 |

Calgary MLS® prices expected to rise in 'balanced' market

Sellers' conditions in B.C., buyers' in Saskatchewan

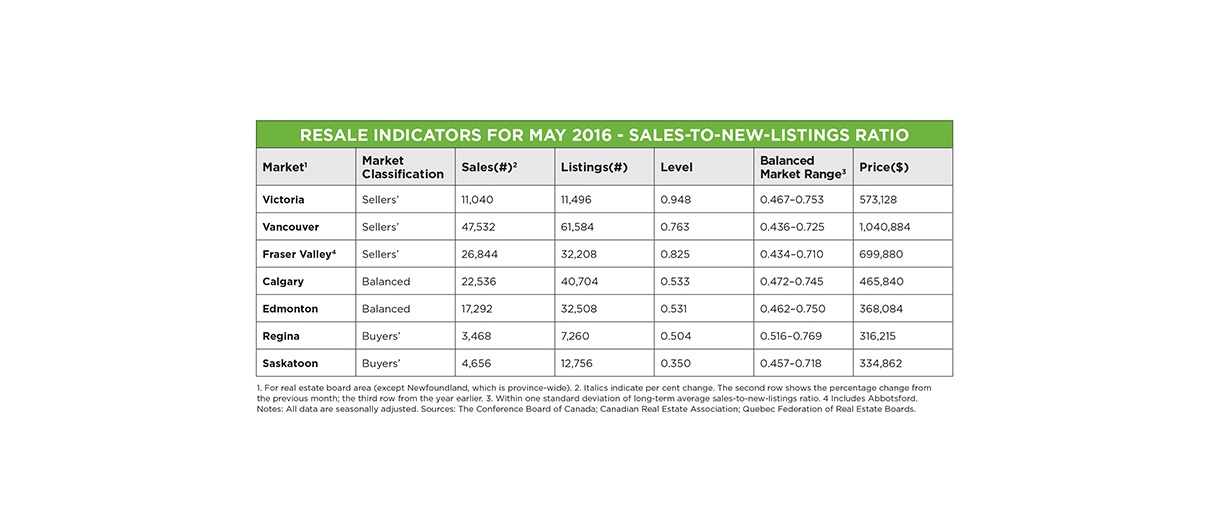

A new report from the Conference Board of Canada says balanced conditions in Calgary's resale housing market are expected to create price gains in the coming months.

In its June Metro Resale Snapshot, the organization anticipates the city's MLS® price will increase between zero and 2.9 per cent over the short term. In May, the house price in Calgary was $465,840, up 1.1 per cent from April and 2.3 per cent from a year ago.

Study author Robin Wiebe classified Calgary's housing market as balanced, noting sales volumes in May increased by 1.6 per cent on a month-over-month basis, while listings declined by 1.9 per cent.

A new report from the Conference Board of Canada says balanced conditions in Calgary's resale housing market are expected to create price gains in the coming months.

In its June Metro Resale Snapshot, the organization anticipates the city's MLS® price will increase between zero and 2.9 per cent over the short term. In May, the house price in Calgary was $465,840, up 1.1 per cent from April and 2.3 per cent from a year ago.

Study author Robin Wiebe classified Calgary's housing market as balanced, noting sales volumes in May increased by 1.6 per cent on a month-over-month basis, while listings declined by 1.9 per cent.

News

May 18, 2016 | CREBNow

Calgary housing prices to decline further: report

CMHC report forecasts buyers' conditions will continue in 2016/17

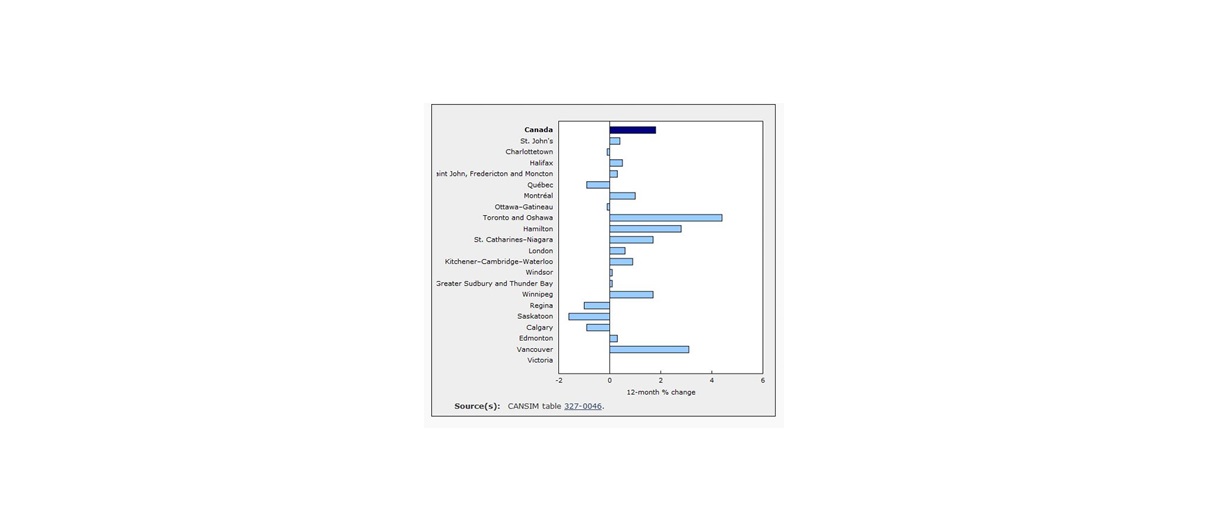

Calgary housing prices will continue to decline in 2016, according to Canada Mortgage and Housing Corp. (CMHC), which predicts the average MLS® residential price in the city will range between $444,500 and $449,500, compared to $453,814 in 2015.

In its semi-annual housing market outlook, released today, CMHC also said it detected moderate evidence of overvaluation as house prices have not been fully supported by economic and demographic fundamentals.

In 2017, house prices in the resale market are anticipated to gradually stabilize as the market shifts to more balanced levels. Improvements in economic conditions and housing demand combined with less supply will help support home prices, said CMHC.

The MLS® average residential price in 2017 is forecast to range from $450,400 to $455,600.

Calgary housing prices will continue to decline in 2016, according to Canada Mortgage and Housing Corp. (CMHC), which predicts the average MLS® residential price in the city will range between $444,500 and $449,500, compared to $453,814 in 2015.

In its semi-annual housing market outlook, released today, CMHC also said it detected moderate evidence of overvaluation as house prices have not been fully supported by economic and demographic fundamentals.

In 2017, house prices in the resale market are anticipated to gradually stabilize as the market shifts to more balanced levels. Improvements in economic conditions and housing demand combined with less supply will help support home prices, said CMHC.

The MLS® average residential price in 2017 is forecast to range from $450,400 to $455,600.

News

May 16, 2016 | Mario Toneguzzi

Calgary is still among most affordable: experts

Household income strong when compared to housing prices, other cities

Calgary homebuyers will continue to fare well as the city's affordability index will likely outpace other major urban centres in the country for the rest of this year, say experts.

RBC Economics senior economist Robert Hogue attributes Calgary's affordability moving forward to continued high household incomes in the city – especially when compared to cities such as Vancouver, Toronto and Montreal

"It's not because house prices are so cheap. It's because it's the market in Canada where the income is the highest," he said. "We measure affordability as a percentage of household income."

Calgary homebuyers will continue to fare well as the city's affordability index will likely outpace other major urban centres in the country for the rest of this year, say experts.

RBC Economics senior economist Robert Hogue attributes Calgary's affordability moving forward to continued high household incomes in the city – especially when compared to cities such as Vancouver, Toronto and Montreal

"It's not because house prices are so cheap. It's because it's the market in Canada where the income is the highest," he said. "We measure affordability as a percentage of household income."

News

March 18, 2016 | Mario Toneguzzi

The many faces of prices

A guide to distinguishing average, median and benchmark prices

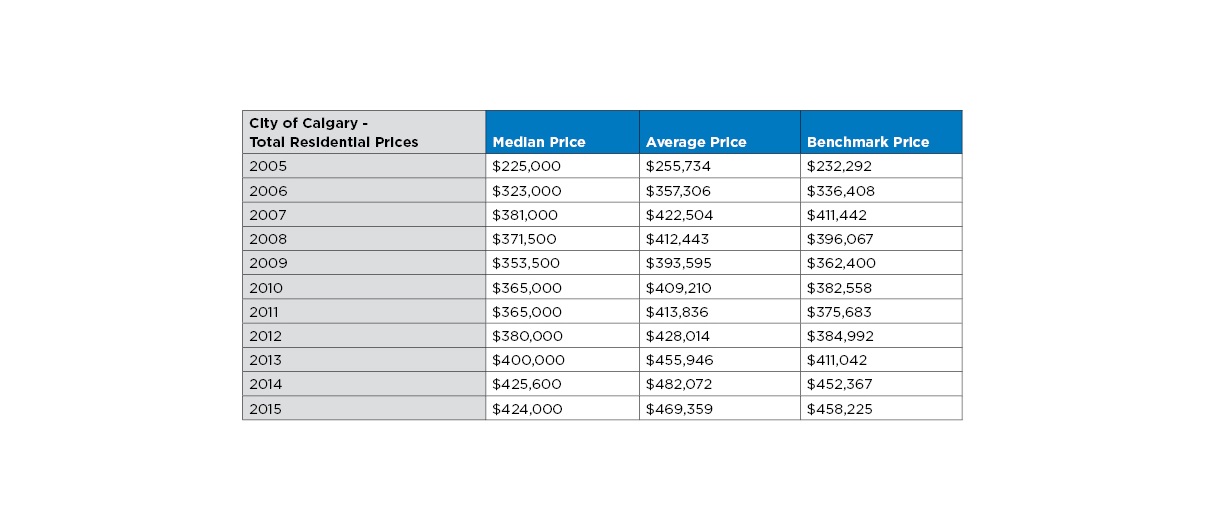

Sellers and potential buyers in today's residential real estate market can be understandably excused if they are confused about what's happening with housing prices.

After all, for both, price changes in the market are supremely important. Plus, CREB® gathers price information that, to the untrained eye, can tell different stories.

For example, in February, CREB® reported the benchmark price in the city for all MLS® properties that were sold was $445,000, or down 3.45 per cent from February 2015. However, the average MLS® sale price increased by 2.72 per cent to $472,529 while the median price was unchanged at $420,000.

From top to bottom, that's a difference of close to $30,000.

So what should one look at if they are either selling a home in this tough market or hoping to buy one?

A good start would be by looking at what each price category entails, said CREB® chief economist Ann-Marie Lurie. For example, the median price looks at every sale that has occurred in the market, ranking them from lowest to highest. The median price is the midpoint of all the sales.

Lurie said the average sale price is adding up the total dollar sum of the purchases divided by the number of total sales.

Sellers and potential buyers in today's residential real estate market can be understandably excused if they are confused about what's happening with housing prices.

After all, for both, price changes in the market are supremely important. Plus, CREB® gathers price information that, to the untrained eye, can tell different stories.

For example, in February, CREB® reported the benchmark price in the city for all MLS® properties that were sold was $445,000, or down 3.45 per cent from February 2015. However, the average MLS® sale price increased by 2.72 per cent to $472,529 while the median price was unchanged at $420,000.

From top to bottom, that's a difference of close to $30,000.

"It's looking at values based on criteria such as square footage, total bedrooms and bathrooms, location, property type."

So what should one look at if they are either selling a home in this tough market or hoping to buy one?

A good start would be by looking at what each price category entails, said CREB® chief economist Ann-Marie Lurie. For example, the median price looks at every sale that has occurred in the market, ranking them from lowest to highest. The median price is the midpoint of all the sales.

Lurie said the average sale price is adding up the total dollar sum of the purchases divided by the number of total sales.

News

Feb. 04, 2016 | Rose Ugoalah

Outside of the box

Shared-equity housing and other programs are creating solutions to the city's affordable housing crisis

Affordable housing advocates say more moderate population growth this year will not be enough to break down barriers to homeownership that many Calgarians continue to face.

Calgary Homeless Foundation vice-president of strategy Kevin McNichol said the housing market still cannot keep up with demand, with historically high prices prohibiting many people from owning a home of their own.

In late December, more than 3,600 people were on the Calgary Housing Company's wait list for subsidized and affordable housing units — the largest number of Calgarians waiting for a home since March 2012.

Affordable housing advocates say more moderate population growth this year will not be enough to break down barriers to homeownership that many Calgarians continue to face.

Calgary Homeless Foundation vice-president of strategy Kevin McNichol said the housing market still cannot keep up with demand, with historically high prices prohibiting many people from owning a home of their own.

In late December, more than 3,600 people were on the Calgary Housing Company's wait list for subsidized and affordable housing units — the largest number of Calgarians waiting for a home since March 2012.

News

Jan. 12, 2016 | Joel Schlesinger

'Just the pre-show'

Global glut for oil means Alberta economy is expected to struggle in 2016 – and Calgary's housing market along with it

Alberta's energy sector has only felt the tip of the blade, say experts, who anticipate the worse is still to come.

"Unfortunately, the story is not positive – and it's not over for Calgary by any stretch of the imagination," said CIBC deputy chief economist Benjamin Tal.

"I think that 2015 was just the pre-show, and we're going to see most of the damage, at least, in the first of half of 2016."

Alberta's energy sector has only felt the tip of the blade, say experts, who anticipate the worse is still to come.

"Unfortunately, the story is not positive – and it's not over for Calgary by any stretch of the imagination," said CIBC deputy chief economist Benjamin Tal.

"I think that 2015 was just the pre-show, and we're going to see most of the damage, at least, in the first of half of 2016."

News

Jan. 12, 2016 | Alex Frazer Harrison

Here we go again

Comparing Calgary's current downturn to history

Calgary's infamous boom-bust economy is at it once again.

Just as it did in the 1980s and late-2000s, economic conditions have once again turned sour.

But does this downturn feel different from those that came before?

Yes, says CREB® chief economist Ann-Marie Lurie.

In CREB®'s 2016 Economic Outlook & Regional Housing Market Forecast, Lurie notes that while some have tried to compare this year to the early 1980s – in terms of its perfect storm of low oil prices and high unemployment – the underlying conditions are, in fact, much different.

Calgary's infamous boom-bust economy is at it once again.

Just as it did in the 1980s and late-2000s, economic conditions have once again turned sour.

But does this downturn feel different from those that came before?

Yes, says CREB® chief economist Ann-Marie Lurie.

In CREB®'s 2016 Economic Outlook & Regional Housing Market Forecast, Lurie notes that while some have tried to compare this year to the early 1980s – in terms of its perfect storm of low oil prices and high unemployment – the underlying conditions are, in fact, much different.