The-Best-of-Both-Worlds---Chart-web

Sept. 19, 2012 | Cody Stuart

Best of Both Worlds

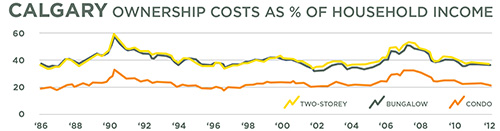

Calgary's housing market has accomplished the "rare feat" of adding improving affordability even with home resales on the rise, says a new report from RBC Economics.In the report, which rates the housing affordability in six major markets across the country, Calgary was singled out for having the "best of all worlds" in improved affordability, resales and homebuilding and moderately rising prices. "Such a combination is a rare feat, but if follows years of sluggish performance in the aftermath of the area's mid-2000s boom," said the report, chalking up some of the increased affordability to a drop in expenses.

"In the second quarter of 2012, a sharp drop in the costs of utilities provided unusual help to affordability in the area. Utilities and property taxes— two small components of homeownership costs—typically do not sway affordability, but the sudden reversal of earlier electricity rate increases led to a substantial 17 per cent quarterly decline in utilities, which was more than enough to move the affordability needle."

According to RBC, purchasing a standard detached bungalow, twostorey and condominium in Calgary would require a homebuyer to part with 36.7, 37.2 and 21.6 per cent, respectively, of their median pre-tax household income. The numbers place the city behind only Edmonton in terms of those markets included in the survey.

The numbers mark a slight improvement over those reported byRBC in the first quarter of 2012, with the expenditures required to buy a two-storey home and condominium dropping by 0.4 and 0.6 per cent, respectively. RBC's affordability measure for a detached bungalow in the city remained the same.

By comparison, purchasing those same homes in Vancouver, which was the least affordable of those markets included in the report, homebuyers would have to shell out a staggering 91, 93.8 and 45.2 per cent, respectively. In Toronto, the second-priciest city included, buying a standard bungalow would take up 54.5 per cent of the household income, while a twostorey home would require 63.9 per cent of the household income.

Edmonton, Calgary's neighbor to the north, ranked first amongst those cities included in the survey, with affordability levels just slightly below those in Calgary.

The RBC Housing Affordability Measures shows the proportion of median pre-tax household income that would be required to service the cost of mortgage payments (principal and interest), property taxes, and utilities on a detached bungalow, a standard two-storey home and a standard condo (excluding maintenance fees) at the going market prices in the Montreal, Toronto, Ottawa, Calgary, Edmonton, and Vancouver metropolitan areas.

The measures are based on a 25 per cent down payment, a 25-year mortgage loan at a five-year fixed rate, and are estimated on a quarterly basis. The average qualifying income - the minimum annual income used by lenders to measure the ability of a borrower to make mortgage payments – for Calgarians in the report was listed at $76,166, while Vancouverites' income was listed at $134,333.

According to RBC, no more than 32 per cent of a borrower's gross annual income should "typically" go to 'mortgage expenses'—principal, interest, property taxes, and heating costs (plus maintenance fees for condos).

Share your thoughts on this post in the comments below.

Tagged: Calgary Real Estate | Calgary Real Estate News | Home Buyers | Home Owners | House & Home | Housing Market | Residential