Feb. 06, 2013 | Cody Stuart

Just Your Typical Calgary Homebuyers

With two kids, two cars and a dog, the Robsons are the image of the typical family.Having purchased a larger home in the city's northwest to accommodate their growing family, the Robsons are typical in another way as well, as they're part of a growing number of Calgarians who are upgrading to bigger and more expensive homes. According to CREB®, total MLS® sales in the city in January were 1,230, up 15.17 per cent, with the average sale price of a home in the city coming in at $439,670. That means Calgary homeowners spent on average 12.34 per cent more this January to buy a home in the city than they did in the same month last year.

"We only had a two bedroom house, and it was smaller. It was great for when it was just the two of us, but when you have more kids, you need more space," said Andrea Robson, who along with her husband Steve, purchased their home in Panorama Hills shortly after putting their previous home up for sale. "[The kids] were getting bigger and when they get bigger, they have more stuff, so we needed more room."

The amenities the Robsons said were important in selecting their new home read like a typical list of must haves for a growing family. In addition to the obvious amenity of more space, Steve said proximity to public transit and major traffic arteries to the downtown core were key, with Andrea adding closeness to schools and a sense of community were vital since the family intends to stay put for some time.

The Robsons purchased their previous home, their first, in Hidden Valley from Andrea's parents after spending many years in the rental market. Andrea said she has seen many of her friends motivated to make similar purchases due to expanding needs.

"A lot of our friends are in the same situations and have done similar things just to get homes that better suit their families," she said.

In accordance with Calgarians looking for bigger and better when it comes to their next housing purchase, January's unadjusted single-family benchmark prices in the city showed improvement over January 2012, increasing by nine per cent.

People can be upgrading due to growing families, better incomes and value in this segment of the market," said CREB® economist Ann- Marie Lurie.

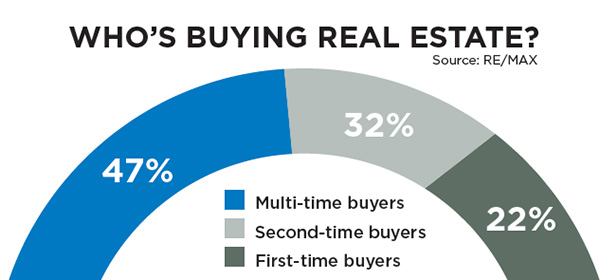

In a survey released by RE/MAX, second-time and multi-time buyers represented 70 per cent of those serious about buying a home — a trend that emerged in the latter half of 2012 and is expected to continue over the next two-year period. While firsttime buyers should continue to play a role in the market — at 30 per cent — the RE/MAX Homebuying Trends Survey showed more experienced buyers will lead the charge for housing over the next 24 months.

"There's no question that first-time buyers are experiencing a period of readjustment," said Gurinder Sandhu, executive vice president, RE/MAX Ontario-Atlantic Canada. "While affordability took a hit in 2012, homeowners with considerable equity remain confident and well positioned. They will be the driving force fuelling the bulk of home sales in the months ahead."

The notion that equity equals assuredness is something that Andrea Robson said played a key role in her families ability to upgrade.

"We had enough equity built up in our last house that we were able to be more confident in the purchase of our second home," she said. "When we bought our first house it was just 'Let's get into the market' and it was a good time to buy. We bought it in 2005 and then everything boomed, so we had a decent amount of equity built up which made it possible for us to buy a bigger house."

Compared to the "boom" referred to by the Robsons, Lurie said homebuyers purchasing today in Calgary are still getting more bang for their buck than back then, a number seemingly reflected in the 15 per cent jump in sales last year.

"What we can say is that compared to 2007 people are getting more home for the same price," she said. "So on a simplistic price per square footage, it is lower than what it was, or consumers are getting more house for the same money. This figure dropped further in January relative to the same period last year."

In January, total MLS® sales were 1,230 units, a significant increase over the 1,068 units in the same month of 2012, but well below January levels recorded through the peak years of 2003 to 2008.

"While activity is typically slower in the winter months, recent improvements in single-family new listings helped support improved sales in that market," said CREB® President Becky Walters. "Overall indicators put the market in balanced conditions."

Single-family sales totalled 879 units in January, a 15 per cent increase over January 2012 levels. New listings remained just above levels recorded at the same time in 2012, for a total of 1,737. The slight improvement in listings helped support sales growth, although inventory levels remain down by double digits.

"Inventory levels have improved relative to December, as is the seasonal trend," Walters said.

The lower level of inventories can pose a challenge for buyers, as they will have to make their buying decisions more quickly than buyers have done over the past four years.

"However, this is by no means a signal that the seller has the advantage," Walters said. "Consumers are fairly price-sensitive and look for value in their purchases."

Calgary Regional Housing Market Statistics from CREB®

Also See:

January 2013 Single Family Statistics by Community

January 2013 Condominium Statistics by Community

January 2013 Town & Country Statistics

Tagged: Calgary Real Estate | Calgary Real Estate News | CREB President Becky Walters | CREB® Chief Economist Ann-Marie Lurie | Growth | Housing Market | Residential