Nov. 22, 2012 | Cody Stuart

CMHC Forecast More Prosperity for Calgary Market

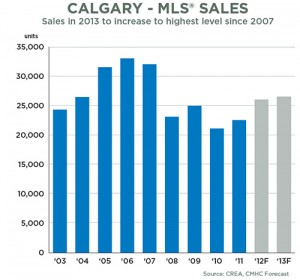

Buoyed by net migration, job prosperity and low mortgage rates, MLS® sales in Calgary this year are expected to reach their highest level since 2007, before increasing even further in 2013.As outlined in the Canada Mortgage and Housing Corporation's (CMHC) annual Calgary Housing Outlook Conference, which took place Nov. 20 at the BMO Centre, Richard Cho, CMHC's senior market analyst for Calgary, said sales in Calgary should increase by almost 16 per cent in 2012 to 26,000 units, rising by another 500 units in 2013 to 26,500. "Sales and price growth in Calgary's resale market is expected to outperform the national average in 2013," said Cho. "Alberta's economy is expected to be one of the strongest in the country, contributing to more employment growth and positive net migration for the province and benefitting housing markets in areas such as Calgary."

According to the CMHC, the number of new Calgarians is expected to hit 20,000 people this year, after numbers dropped to just 9,209 in 2010 and 11,220 in 2011. For 2013, CMHC is forecasting net migration to "moderate", reaching 18,000.

The last time MLS® sales in Calgary reached similar levels to the ones being forecast by CMHC was 2007, when sales topped 32,000.

However, unlike the escalation in activity that occurred then, the increase in sales heading into 2013 is not expected to be accompanied by an unsustainable price increases.

According to CMHC, the average price for the Calgary region is forecast to increase two per cent from $402,851 in 2011 to $411,000 in 2012, while the average price in 2013 is expected to reach $422,000, up nearly three per cent from a year earlier. Compare that increase to the dramatic rise that took place between 2004 and 2007, when the average price of a Calgary home increased 186 per cent, rising from $227,269 to $423,770.

"Fundamentals in the economy are expected to continue to support the Calgary resale market next year, as we anticipate moderate growth in both prices and sales activity," said CREB® economist Ann-Marie Lurie.

CMHC's forecast comes alongside a report from the Canadian Association of Accredited Mortgage Professionals (CAAMP) that places some perspective around the relative prosperity in the Calgary housing market.

According to CAAMP chief economist Will Dunning, the fact the Calgary market is performing as well as it is and expected to continue to do so is testament to the confidence of buyers in the city, given recent changes in the nation's mortgage rules.

"During 2012, Calgary's homebuyers have finally regained confidence in the housing market, and have returned to the market – at a time when many other areas of Canada have seen a moderation," said Dunning, who also serves as president of Will Dunning Inc., a company that specializes in economic analysis of housing markets.

"This resurgence in confidence in Calgary has enabled it to avoid the 'policy-induced housing market downturn' that is affecting so many other areas of Canada."

According to CAAMP's latest Annual State of the Residential Mortgage Market in Canada report, since the most recent round of mortgage tightening came into effect in July 2012, there has been a drop in Canadian housing resale activity: between August and October, sales were eight per cent lower than in the year prior to the announcement.

"The housing resale numbers behave like a canary in the mine for us," said Dunning. "Since the government tightened mortgage accessibility for the fourth time this past July we've seen a drop in [Canada-wide] resale activity that I think foreshadows an overall decline in the [national] housing market. My concern is that a policy-induced housing market downturn creates unnecessary risk that directly affects not just housing but job creation and the economy as a whole."

Tagged: Alberta Real Estate | Calgary Community | Calgary Housing Market | Calgary Real Estate | Calgary Real Estate News | CMHC | Development | Economy | Growth | Home Price Index | Residential